UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Inhibikase Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

INHIBIKASE THERAPEUTICS, INC.

3350 RIVERWOOD PARKWAY SE, SUITE 1900

ATLANTA, GEORGIA 30339

(678) 392-3419

April [ ], 2024

Dear Fellow Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Inhibikase Therapeutics, Inc. (“Inhibikase,” the “Company,” “we” or “us”) to be held at 4:00 p.m., Eastern Time, on Friday, June 7, 2024.

We are very pleased that this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast, with no physical in-person meeting. You will be able to virtually attend the 2024 Annual Meeting of Stockholders online and submit your questions during the meeting by visiting https://web.lumiconnect.com/235841686, password inhibikase2024. You will also be able to vote your shares electronically at the annual meeting. You will not be able to attend the annual meeting in person.

We are pleased to use the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate from any location.

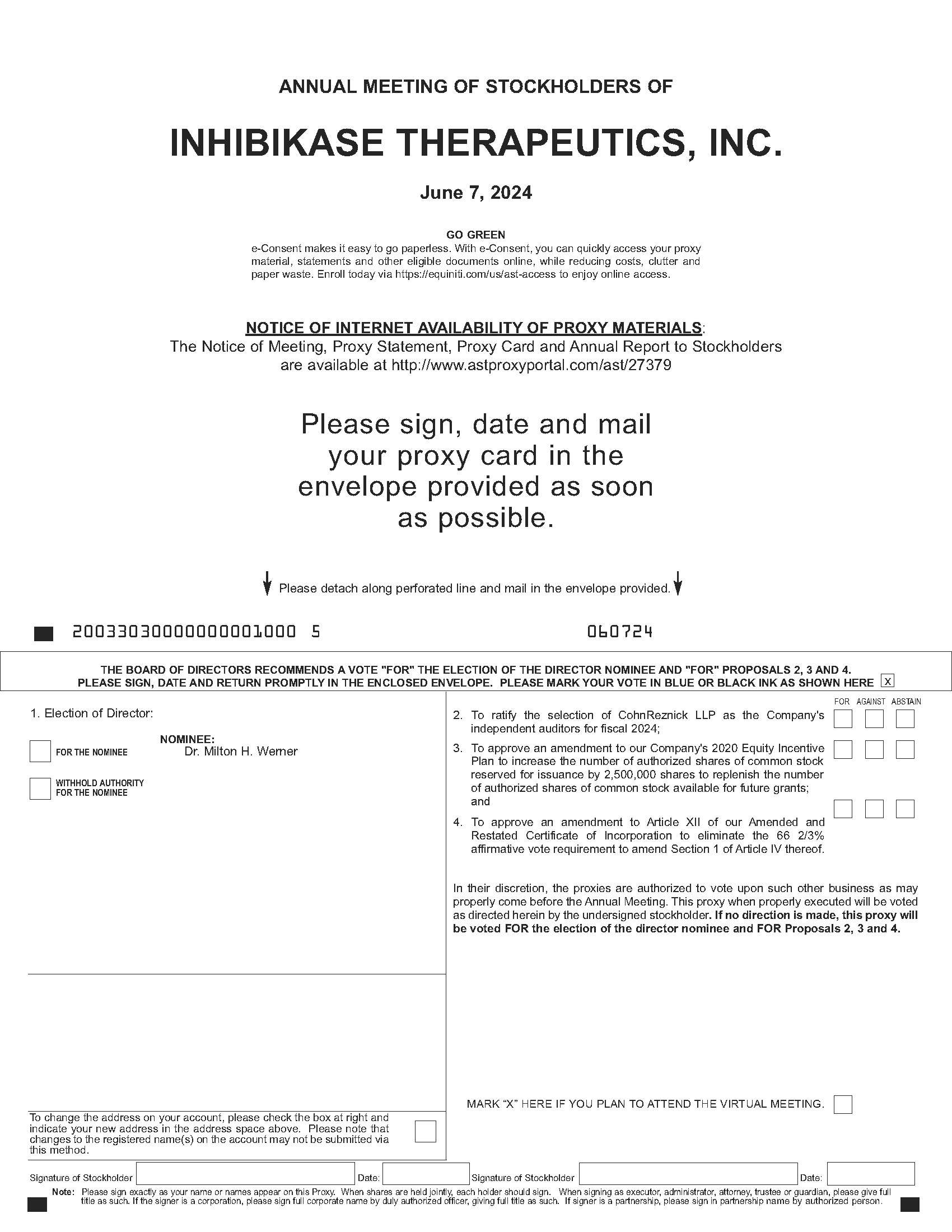

At the meeting, you will be asked to (i) elect one director to the Board of Directors of the Company (the “Board of Directors”) to serve as a Class I director, (ii) ratify our appointment of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, (iii) approve an amendment to the Company’s 2020 Equity Incentive Plan to increase the number of authorized shares of common stock reserved for issuance by 2,500,000 shares to replenish the number of authorized shares of common stock available for future grants, and (iv) approve an amendment to Article XII of our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to eliminate the 66 2/3% affirmative vote requirement for amendments to Section 1 of Article IV thereof. In addition, we will be pleased to report on our affairs and a discussion period will be provided for questions and comments of general interest to stockholders. Detailed information with respect to these matters is set forth in the accompanying Proxy Statement, which we encourage you to carefully read in its entirety.

We look forward to greeting personally those stockholders who are able to attend the meeting online. However, whether or not you plan to join us at the meeting, it is important that your shares be represented. Stockholders of record at the close of business on April 15, 2024 are entitled to notice of and to vote at the meeting. We will be using the “Notice and Access” method of providing proxy materials to you via the Internet. On or about April 26, 2024, we will mail to our stockholders a Notice of Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and our 2023 Annual Report on Form 10-K and vote electronically via the Internet. The Notice also contains instructions on how to receive a printed copy of your proxy materials.

You may vote over the Internet, as well as by telephone or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. Please review the instructions for each of your voting options described in the Proxy Statement, as well as in the Notice you will receive in the mail.

Thank you for your ongoing support of Inhibikase.

Very truly yours, |

|

/s/ Milton H. Werner

|

Milton H. Werner, Ph.D. President and Chief Executive Officer |

INHIBIKASE THERAPEUTICS, INC.

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Inhibikase Therapeutics, Inc. (“Inhibikase” or the “Company”), will be held via live webcast on the Internet on Friday, June 7, 2024 at 4:00 p.m., Eastern Time, for the following purposes:

These matters are more fully described in the accompanying Proxy Statement.

You will be able to virtually attend the annual meeting, vote and submit your questions during the meeting by visiting https://web.lumiconnect.com/235841686, password inhibikase2024 and entering the 11-digit control number included in the Notice of Internet Availability or proxy card that you receive. For further information about the virtual annual meeting, please see the section entitled “About the Annual Meeting” beginning on page 1 of the Proxy Statement.

Only stockholders of record at the close of business on April 15, 2024 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. We have decided that the Annual Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting. Stockholders will have the ability to attend, vote and submit questions before and during the virtual meeting from any location via the Internet at https://web.lumiconnect.com/235841686, password inhibikase2024.

A complete list of these stockholders will be available in electronic form at the Annual Meeting and will be accessible for ten days prior to the Annual Meeting. All stockholders are cordially invited to virtually attend the Annual Meeting. On or about April 26, 2024, the Company will mail to its stockholders a Notice of Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and our 2023 Annual Report on Form 10-K, how to vote electronically via the Internet or vote by telephone, and how to request printed proxy materials.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and submit your proxy or voting instructions as soon as possible by Internet, telephone or mail. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you will receive in the mail, the section entitled “About the Annual Meeting” beginning on page 1 of the Proxy Statement or, if you request to receive printed proxy materials, your enclosed proxy card. Please note that shares held beneficially in street name may be voted by you at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares.

Very truly yours, |

|

/s/ Milton H. Werner

|

Milton H. Werner, Ph.D. President and Chief Executive Officer |

Atlanta, Georgia

April [ ], 2024

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders

To Be Held on June 7, 2024

The Proxy Statement, along with our 2023 Annual Report on Form 10-K, is available free of charge at the following website: http://www.astproxyportal.com/ast/23797.

Table of Contents

INHIBIKASE THERAPEUTICS, INC.

3350 RIVERWOOD PARKWAY SE, SUITE 1900

ATLANTA, GEORGIA 30339

PROXY STATEMENT

Our Board of Directors has made this Proxy Statement and related materials available to you on the Internet, or, upon your request, has delivered printed proxy materials to you by mail, in connection with the Board of Directors’ solicitation of proxies for use at the 2024 Annual Meeting of Stockholders of Inhibikase Therapeutics, Inc. to be held online on Friday, June 7, 2024, beginning at 4:00 p.m., Eastern Time, and at any postponements or adjournments of the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement.

ABOUT THE ANNUAL MEETING

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners as of the record date (for more information on the record date, see “– Who is entitled to vote at the Annual Meeting?”). The mailing of the Notice to our stockholders is scheduled to begin on or about April 26, 2024. All stockholders will have the ability to access the proxy materials and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”) on a website referred to in the Notice or to request to receive a printed set of the proxy materials and the Annual Report. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. Stockholders may also request to receive proxy materials and our Annual Report in printed form by mail or electronically by email on an ongoing basis.

How do I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how you can:

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. Stockholders may also request to receive proxy materials and our Annual Report in printed form by mail or electronically by email on an ongoing basis. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting accompanying this Proxy Statement, consisting of voting on proposals to (i) elect one director to the Board of Directors of the Company (the “Board of Directors”) to serve as the Class I director; (ii) ratify our appointment of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, (iii) approve an amendment to the Company’s 2020 Equity Incentive Plan to increase the number of authorized shares of common stock reserved for issuance by 2,500,000 shares to replenish the number of authorized shares of common stock available for future grants, and (iv) approve an amendment to Article XII of our Certificate of Incorporation to eliminate the 66 2/3% affirmative vote requirement for amendments to Section 1 of Article IV thereof, and transacting such other business that may properly come before the meeting or any postponement or adjournment thereof. In addition, management will report on our performance

-1-

during the fiscal year ended December 31, 2023 and more recent developments and respond to questions from stockholders. Our Board of Directors is not currently aware of any other matters which will come before the meeting.

How do proxies work and how are votes counted?

The Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Annual Meeting in the manner you direct. You may vote for our director nominee or withhold your vote as to our director nominee. You may also vote for or against, or abstain from voting on the ratification of our selection of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 or approving the proposed amendment to our Certificate of Incorporation. If a stockholder of record does not indicate instructions with respect to one or more matters on his, her or its proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors (for more information, see “– How does the Board of Directors recommend that I vote?”). If a beneficial owner of shares held in street name does not provide instructions to the bank, broker, or other nominee holding those shares, please see the information below under the caption “– What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 15, 2024, the record date for the meeting, are entitled to receive notice of and to participate in the Annual Meeting, or any postponements and adjournments of the meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponements or adjournments of the meeting.

On April 15, 2024, the record date for the meeting, there were 6,476,844 shares of our common stock outstanding. Each outstanding share of common stock is entitled to one vote on each of the matters presented at the Annual Meeting or postponements and adjournments of the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock as of the record date will constitute a quorum, permitting the Annual Meeting to conduct its business. As of the record date, 6,476,844 shares of common stock, representing the same number of votes, were outstanding. Thus, the presence of holders representing at least 3,238,423 shares will be required to establish a quorum.

If a stockholder abstains from voting as to any matter or matters, the shares held by such stockholder shall be deemed present at the Annual Meeting for purposes of determining a quorum. If a bank, broker, or other nominee returns a “broker non-vote” proxy, indicating a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the bank, broker, or other nominee to vote on a particular matter but has discretionary authority as to at least one matter, then the shares covered by such broker non-vote proxy shall be deemed present at the Annual Meeting for purposes of determining a quorum. For more information on discretionary and non-discretionary matters, see “– What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

What vote is required to approve each matter and how are votes counted?

Proposal No. 1: Election of Class I Director

The nominee who receives the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote on the election of directors will be elected as our Class I director. Abstentions, broker non-votes and instructions on the accompanying proxy card to withhold authority to vote for one or more nominees will have no effect on the results of election of directors.

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm

The affirmative vote of a majority of the issued and outstanding shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting by a stockholder present in person or represented by proxy at the meeting or a broker non-vote by a broker who elects to non-vote instead of using its discretion to vote has the same legal effect as a vote “against” the matter.

-2-

Proposal No. 3: Approval of an Amendment to the Company’s 2020 Equity Incentive Plan to Increase the Number of Authorized Shares of Common Stock Reserved for Issuance by 2,500,000 Shares to Replenish the Number of Authorized Shares of Common Stock Available for Future Grants

The affirmative vote of a majority of the outstanding shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting by a stockholder present in person or represented by proxy at the meeting has the same legal effect as a vote “against” the matter. A broker non-vote for which the broker does not have voting discretion will be excluded entirely from the vote and will therefore have no effect on the outcome of the vote for this matter.

Proposal No. 4: Approval of an Amendment to Article XII of our Certificate of Incorporation to Eliminate the 66 2/3% Affirmative Vote Requirement for Amendments to Section 1 of Article IV Thereof

The affirmative vote of the holders of 66 2/3% of the issued and outstanding shares of our common stock entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting by a stockholder present in person or represented by proxy at the meeting or a broker non-vote has the same legal effect as a vote “against” the matter.

How can you attend the Annual Meeting?

We will be hosting the Annual Meeting live via audio webcast. Any stockholder can attend the Annual Meeting live online at https://web.lumiconnect.com/235841686, password inhibikase2024. If you were a stockholder as of the record date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

To attend and participate in the Annual Meeting, you will need the 11-digit control number included in the Notice, on your proxy card, or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 11-digit control number or otherwise vote through the bank or broker. If you lose your 11-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the record date.

Why hold a virtual meeting?

We are excited to use the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. We believe the virtual meeting format enables increased stockholder attendance and participation because stockholders can participate from any location around the world.

How do I ask questions at the virtual Annual Meeting?

During the virtual Annual Meeting, you may only submit questions in the question box provided at https://web.lumiconnect.com/235841686, password inhibikase2024. We will respond to as many inquiries at the virtual Annual Meeting as time allows.

-3-

What if during the check-in time or during the virtual Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting website log-in page.

How can I vote my shares?

Record Owners and Beneficial Owners Who Have Been Provided With a 11 Digit Control Number

If you are a record holder, meaning your shares are registered in your name and not in the name of a broker, trustee, or other nominee, or a beneficial owner who has been provided by your broker with an 11 digit control number, you may vote:

1. Over the Internet – If you have Internet access, you may authorize the voting of your shares by accessing www.voteproxy.com and following the instructions set forth in the Proxy Materials. You must specify how you want your shares voted or your vote will not be completed and you will receive an error message. Your shares will be voted according to your instructions. You can also vote during the meeting by visiting https://web.lumiconnect.com/235841686, password inhibikase2024 and having available the 11 digit control number included on your proxy card or on the instructions that accompanied your Proxy Materials.

2. By Telephone – If you are a registered stockholder or a beneficial owner who has been provided with a control number on the voting instruction form that accompanied your Proxy Materials, you may call toll-free 1-800-PROXIES (1-800-776-9437) in the United Sates or 1-201-299-4446 from foreign countries to vote by telephone. Your shares will be voted according to your instructions.

3. By Mail If You Are a Record Owner – Complete and sign the attached WHITE proxy card and mail it in the enclosed postage prepaid envelope. Your shares will be voted according to your instructions. If you sign your WHITE proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. Unsigned proxy cards will not be voted.

Beneficial Owners

As the beneficial owner, you have the right to direct your broker, trustee, or other nominee on how to vote your shares. In most cases, when your broker provides you with proxy materials, they will also provide you with an 11 digit control number, which will allow you to vote as described above or at the Annual Meeting. If your broker has not provided you with an 11 digit control number, please contact your broker for instructions on how to vote your shares.

Stockholders who submit a proxy by Internet or telephone need not return a proxy card or any form forwarded by your broker, bank, trust or nominee. Stockholders who submit a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or telephone, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder.

What am I voting on at the Annual Meeting?

The following proposals are scheduled for a vote at the Annual Meeting:

-4-

Each of these proposals is described in further detail below.

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not currently aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Dr. Milton Werner, Chief Executive Officer, and Garth Lees-Rolfe, Chief Financial Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason the nominee is not available as a candidate for director, the persons named as proxies will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

How does the Board of Directors recommend that I vote?

As to the proposals to be voted on at the Annual Meeting, the Board of Directors unanimously recommends that you vote:

What if I am a stockholder of record and do not indicate voting instructions on my proxy?

If you are a stockholder of record and provide specific instructions on your proxy with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated on your proxy for one or more of the proposals to be voted on, the shares will be voted as recommended by the Board of Directors: (i) in favor of our Class I director nominee, (ii) for the ratification of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, (iii) to approve an amendment to the Company’s 2020 Equity Incentive Plan to increase the number of authorized shares of common stock reserved for issuance by 2,500,000 shares to replenish the number of authorized shares of common stock available for future grants, and (iv) to approve an amendment to Article XII of our Certificate of Incorporation to eliminate the 66 2/3% affirmative vote requirement for amendments to Section 1 of Article IV thereof. If any other matters are properly presented for consideration at the meeting, the individuals named as proxy holders, Dr. Milton Werner and Garth Lees-Rolfe, will vote the shares that they represent on those matters as recommended by the Board of Directors. If the Board of Directors does not make a recommendation, then they will vote in accordance with their best judgment.

What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?

As a beneficial owner, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your bank, broker, or other nominee by the deadline provided in the materials you receive from your bank, broker, or other nominee or vote by mail, telephone or Internet according to instructions provided by your bank, broker, or other nominee. If you do not provide voting instructions to your bank, broker, or other nominee, whether your shares can be voted by such person or entity depends on the type of item being considered for vote.

-5-

We encourage you to provide instructions to your broker regarding the voting of your shares.

Can I change my vote or revoke my proxy?

Yes. If you are a stockholder of record, you may revoke your proxy by (i) following the instructions on the Notice and entering a new vote by telephone or over the Internet up until 11:59 P.M. Eastern Time on June 6, 2024, (ii) attending the Annual Meeting and voting (although attendance at the Annual Meeting will not in and of itself revoke a proxy) or (iii) entering a new vote by mail. Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the holding of the vote at the Annual Meeting at 4:00 p.m., Eastern Time, on June 7, 2024. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or sent to the Company’s principal executive offices at 3350 Riverwood Parkway SE, Suite 1900, Atlanta, Georgia 30339, Attention: Corporate Secretary. If a broker, bank, or other nominee holds your shares, you must contact them in order to find out how to change your vote.

The last proxy or vote that we receive from you will be the vote that is counted.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting.

Who will bear the cost of soliciting votes for the Annual Meeting?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We have engaged Kingsdale Shareholder Services US LLC (“Kingsdale Advisors”) to assist in soliciting proxies on our behalf. Kingsdale Advisors may solicit proxies personally, electronically or by telephone. We have agreed to pay Kingsdale Advisors a fee of $10,500 plus $4.50 per telephone call and $6.00 per QuickVote received for its services. QuickVote is a service that allows Kingsdale Advisers to record the votes of certain of our stockholders. We have also agreed to reimburse Kingsdale Advisors for its reasonable out-of-pocket expenses and to indemnify Kingsdale Advisors and its employees against certain liabilities arising from or in connection with the engagement.

What is “householding” and where can I get additional copies of proxy materials?

For information about householding and how to request additional copies of proxy materials, please see the section captioned “Householding of Proxy Materials.”

Whom may I contact if I have other questions about the Annual Meeting or voting?

You may contact the Company at 3350 Riverwood Parkway SE, Suite 1900, Atlanta, Georgia 30339, Attention: Milton H. Werner, Ph.D., or by telephone at (678) 392-3419. You may also contact Kingsdale Advisors by telephone at 1-855-682-9644.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. Voting results will be disclosed on a Form 8-K filed with the SEC within four business days after the Annual Meeting, which will also be available on our website.

-6-

We encourage you to vote by proxy over the Internet or by telephone by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided on the proxy card.

-7-

PROPOSAL NO. 1

ELECTION OF CLASS I DIRECTOR

One director is to be elected at the Annual Meeting to serve as our Class I director until the Company’s 2027 annual meeting of stockholders, or until their successor is duly elected and qualified. The Class I director nominee is a current director and has been nominated for re-election by our Board of Directors. The Company intends that the proxy in the form presented will be voted, unless otherwise indicated, for the election of the Class I director nominee to serve until the 2027 annual meeting of stockholders, or until their successor is duly elected and qualified. Our Certificate of Incorporation provides that the number of directors that constitute the entire Board of Directors shall be determined in the manner designated in the Company’s bylaws. The Company’s Amended and Restated Bylaws provide that the number of directors is determined by resolution of the Board of Directors, provided that the Board of Directors shall consist of at least one member.

Should the Class I director nominee be unable to accept nomination or election as a director, the individuals named as proxy holders, Dr. Milton Werner and Garth Lees-Rolfe, will vote the shares that they represent for such other person as the Board of Directors may recommend. The Board of Directors has no present knowledge that the Class I director nominee named below will be unavailable to serve.

The Class I director standing for re-election, together with his age and certain other information, is:

Director

|

Age

|

Year First

|

Principal Occupation and Other Board of Directors Service

|

Milton H. Werner, Ph.D. |

61 |

2010 |

Milton H. Werner, Ph.D. has been our President and Chief Executive Officer and a member of our board of directors since our formation as a Delaware corporation in June 2010. He founded our predecessor, Inhibikase Therapeutics, LLC, in 2008 as an entrepreneurial start-up in Atlanta, Georgia with initial financial support from the Georgia Research Alliance. Prior to founding Inhibikase, from May 2007 until August 2008, Dr. Werner served as Director of Research at Celtaxsys, Inc., a cell-free immunotherapeutics company. From September 1996 until June 2007, Dr. Werner was a Head of the Laboratory of Molecular Biophysics at The Rockefeller University and departed the University at the rank of Associate Professor. While at The Rockefeller University, Dr. Werner focused on developing more complete understandings of mechanisms of human disease in immunology, oncology and infectious disease. Dr. Werner is the author or co-author of more than 70 research articles, reviews and book chapters and has given lectures on his research work on more than 150 occasions throughout the world. He is the recipient of numerous private and public research grants totaling more than $21 million, and of several awards, including the Young Investigator Award from the Sidney Kimmel Cancer Foundation, the Research Chair from the Brain Tumor Society and a $1 million Distinguished Young Scholars in Medical Research award from the W. M. Keck Foundation. He is also an Adjunct Full Professor in the School of Biology at the Georgia Institute of Technology and a Member of the Winship Cancer Institute of Emory University, both in Atlanta, Georgia. Dr. Werner received his Ph.D. in Chemistry from the University of California, Berkeley and his B.S. in Biochemistry from the University of Southern California. He also completed his post-doctoral training at the National Institute of Health with a specialization in structural biology. We believe Dr. Werner is qualified to serve on our board of directors because of the perspective and experience he provides as our founder and as our President and Chief Executive Officer, as well as his experience within the pharmaceutical industry, particularly in the area of neuroscience, infectious disease and drug discovery and development. |

No family relationships exist between any director, executive officer or person nominated or chosen to be a director or officer.

Delinquent Section 16(a) Reports

-8-

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially own more than 10% of a registered class of our common stock, to file initial reports of ownership and reports of changes in ownership with the SEC. These officers, directors and stockholders are required by SEC regulations to furnish us with copies of all reports that they file.

Based solely upon a review of copies of the reports furnished to us during the year ended December 31, 2023 and thereafter, or any written representations received by us from directors, officers and beneficial owners of more than 10% of our common stock (“reporting persons”) that no other reports were required, we believe that all reporting persons filed on a timely basis all reports required by Section 16(a) of the Exchange Act during the year ended December 31, 2023.

The Board of Directors unanimously recommends a vote “FOR” the election of

the Class I director nominee to the Board of Directors named in this Proposal No. 1.

-9-

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee of the Board of Directors has appointed CohnReznick LLP (“CohnReznick,” the “principal accountant” or the “independent accountant”) as the independent registered public accounting firm to audit our consolidated financial statements as of and for the fiscal year ending December 31, 2024. CohnReznick has been our independent registered public accounting firm since it was appointed in April 2018 to audit our consolidated financial statements for the fiscal year ended December 31, 2016. Since that date, CohnReznick has also provided us certain tax and other audit-related services. The Board of Directors has directed that management submit the selection of our independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Representatives of CohnReznick are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions. Notwithstanding its selection, the Board of Directors, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the Board of Directors believes that such a change would be in our and our stockholders’ best interests. If the appointment is not ratified by our stockholders, the Board of Directors may reconsider whether it should appoint another independent registered public accounting firm.

Audit and Other Fees

The following table sets forth the aggregate fees billed by CohnReznick LLP in connection with audit and other services rendered during the past two fiscal years.

|

|

12/31/2023 |

|

|

12/31/2022 |

|

||

Audit Fees(1) |

|

$ |

259,927 |

|

|

$ |

238,900 |

|

Audit-Related Fees(2) |

|

— |

|

|

|

40,145 |

|

|

Tax Fees(3) |

|

|

42,685 |

|

|

|

23,000 |

|

Total |

|

$ |

302,612 |

|

|

$ |

302,045 |

|

Audit Committee Report

The audit committee operates under a written charter approved by the Board of Directors, which provides that its responsibilities include assisting the Board of Directors in monitoring the integrity of the Company’s financial statements, the qualifications and independence of the Company’s independent auditors, the performance of the Company’s internal audit function and independent auditors and the compliance by the Company with legal and regulatory requirements. For more information on the audit committee, see “Management and Corporate Governance – Board of Directors Committees – Audit Committee.”

The audit committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s internal controls, financial reporting process, and compliance with laws and regulations and ethical business standards. CohnReznick was responsible for performing an independent audit of the Company’s consolidated financial statements for the fiscal year ended December 31, 2023 in accordance with the standards of the Public Company Accounting Oversight Board of Directors (United States) (the “PCAOB”). The audit committee’s main responsibility is to monitor and oversee this process.

The audit committee reviewed and discussed our audited consolidated financial statements as of and for the fiscal year ended December 31, 2023 with management. The audit committee discussed with CohnReznick the matters required to be

-10-

discussed by PCAOB Auditing Standard No. 16. The audit committee has received the written disclosures and the letter from the independent accountant required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

The audit committee is responsible to consider any fees paid to CohnReznick for the provision of non-audit related services. All non-audit related services rendered by CohnReznick for the fiscal years ended December 31, 2023 and December 31, 2022 were approved by the audit committee.

Based on the review and discussions referred to above in this report, the audit committee recommended to the Board of Directors that such audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the SEC.

THE AUDIT COMMITTEE

Gisele Dion (Chairperson)

Paul Grint, M.D.

Dennis Berman

Audit Committee Pre-Approval Policies and Procedures

The audit committee is responsible for appointing, retaining, setting compensation for, and evaluating and overseeing the work of the independent registered public accounting firm. The audit committee’s charter establishes a policy that all audit and permissible non-audit services provided by the independent registered public accounting firm will be pre-approved by the audit committee.

All such audit and permissible non-audit services were pre-approved in accordance with this policy during the fiscal year ended December 31, 2023. These services may include audit services, audit-related services, tax services and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our independent registered public accounting firm. The responsibility to pre-approve audit and non-audit services may be delegated by the audit committee to one or more members of the audit committee; provided that any decisions made by such member or members must be presented to the full audit committee at its next scheduled meeting.

The Board of Directors deems Proposal No. 2 “Ratification of Appointment of Independent Registered Accounting Firm” to be in our and our stockholders’ best interests and unanimously recommends a vote “FOR” approval thereof.

-11-

PROPOSAL NO.3

approval of an amendment to the Company’s 2020 Equity Incentive Plan to increase the number of authorized shares of common stock reserved for issuance by 2,500,000 shares to replinish the number of authorized shares of common stock avaIlable for future grants

Introduction

We are asking you to approve an amendment to the Company’s 2020 Equity Incentive Plan, a copy of which is attached as Appendix A hereto (the “Plan Amendment”), to increase the number of authorized shares of common stock reserved for issuance by an additional 2,500,000 shares to replenish the number of authorized shares of common stock available for future grants. In this proxy statement, we refer to the Company’s current 2020 Equity Incentive Plan as the “Current Plan” or the “2020 Plan,” and we refer to the Current Plan, as modified by the Plan Amendment, as the “Amended Plan.” On March 21, 2024, the Board of Directors approved the Plan Amendment, subject to stockholder approval, and directed that the Amended Plan be submitted to our stockholders for their approval at the Annual Meeting. The Amended Plan does not contain any modifications, alterations or revisions of any other term or provision of our Current Plan except with respect to the increase in the share reserve.

As of April 1, 2024, we had only 988,792 shares of common stock that remained available for issuance under the Current Plan. If Proposal No. 3 is approved, the Plan Amendment will become effective with respect to the increase in the number of authorized shares of common stock reserved for issuance. Without approval by stockholders of the Plan Amendment, the Company will be unable to continue to grant equity awards once the share pool is depleted, potentially resulting in the loss of employees and difficulties in recruiting new employees. If the Plan Amendment is not approved, the Company will become increasingly reliant on cash-based compensation, which will deplete the Company’s finite cash resources. Accordingly, the Board of Directors recommends the approval of the Plan Amendment.

We recognize that issuance of employee, officer or director incentive options may one day have a dilutive impact on our stockholders. We balance this concern against the competitive market to hire the best employees who will maximize commitment to the Company. Incentive options are one of the strongest motivators of employee, officer and director performance. In determining the appropriate number of shares to request and add to the pool of shares available for issuance, the Board of Directors and the compensation committee of the Board of Directors worked with management to evaluate a number of factors and carefully considered (i) the potential dilutive impact that the increase would have on our stockholders, (ii) our historical burn rate and overhang, (iii) the number of shares remaining available under the Current Plan, (iv) the realities of equity awards being a key component of designing competitive compensation packages necessary for retaining key talent and directors in a competitive marketplace, specifically in light of our negative operating cashflows and historical operating losses, (v) our strategic growth plans, and (vi) the interests of our stockholders. The compensation committee monitors our equity award process to ensure that we maximize stockholder value by granting only the appropriate number of equity awards necessary to attract, reward and retain employees and directors. In addition, the Current Plan includes, and the Amended Plan will include, provisions designed to be less dilutive to stockholders. As described further below, the Current Plan does not, and the Amended Plan will not, contain an “evergreen” provision, so the number of shares available for issuance under the Current Plan does not automatically increase each year and likewise will not automatically increase under the Amended Plan. The below table summarizes grants under our Current Plan for the last three fiscal years.

Name |

|

Options Granted |

|

|

RSUs Granted |

|

|

Weighted Average |

|

|||

2023 |

|

|

111,669 |

|

|

|

— |

|

|

|

5,333,096 |

|

2022 |

|

|

138,319 |

|

|

|

— |

|

|

|

4,223,099 |

|

2021 |

|

|

35,989 |

|

|

|

— |

|

|

|

3,034,866 |

|

Maintaining our current equity compensation program is particularly critical at this time when competition for quality personnel is intense in the highly competitive biotechnology marketplace in which we operate, and our ability to successfully

-12-

execute, compete and deliver value to stockholders could be significantly negatively impacted if we cannot maintain our current equity award practices in support of retaining and attracting key talent. If we are limited in our ability to grant desired equity awards to our employees and other eligible individuals, we may not be able to compete for or retain key talent, and/or we may have to increase cash-based compensation incentives, which could work against our current philosophy of aligning the interests of our personnel with the interests of our stockholders. This course of action could also be a distraction for our management team and employees because it would disrupt the normal and scheduled operations of our compensation programs and restrict their ability to utilize equity grants to retain and motivate our employees and other key talent.

In recent years, our ability to offer competitive equity compensation packages was integral to hiring and retaining key performers who are instrumental in the operations of the Company. For these reasons, we believe it is critically important to approve the Plan Amendment at this time to ensure we have a sufficient number of shares authorized for issuance under the Amended Plan.

History of the Current Plan

On July 21, 2020, the Board of Directors and our stockholders approved the Current Plan. The Current Plan became effective immediately prior to the closing of the Company’s December 2020 initial public offering. The Current Plan provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock or restricted stock units to any of its employees, directors, consultants and other service providers or those of its affiliates. The Board of Directors has designated the compensation committee to administer the Current Plan. The compensation committee has broad authority to administer the Current Plan and to determine the vesting conditions for awards. Neither the compensation committee nor the Board of Directors is authorized to reprice outstanding options or stock appreciation rights without stockholder consent. In addition, any amendments to increase the total number of shares reserved for issuance under the Current Plan or modification of the classes of participants eligible to awards requires ratification by the stockholders. Subject to certain adjustments, the maximum number of shares of common stock that may be issued under the Current Plan in connection with awards is limited to 988,792 shares. On March 21, 2024, the Board of Directors approved and adopted the Plan Amendment, subject to stockholder approval at the Annual Meeting, to increase the number of authorized shares of common stock reserved for issuance pursuant to the Current Plan by 2,500,000 to replenish the number of authorized shares of common stock available for future grants.

Following the effectiveness of the Current Plan, the Company ceased making grants under its 2011 Equity Incentive Plan. However, the 2011 Equity Incentive Plan continues to govern the terms and conditions of the outstanding awards granted under the 2011 Equity Incentive Plan. Shares of common stock subject to awards granted under the 2011 Equity Incentive Plan that cease to be subject to such awards by forfeiture or otherwise after the effective date of the Current Plan will become available for issuance under the Current Plan or, if approved, the Amended Plan.

Equity Compensation Plan Information

The table below sets forth information with respect to compensation plans under which our equity securities are authorized for issuance as of April 15, 2024:

Plan Category |

|

Number of securities |

|

|

Weighted-average |

|

|

Number of securities |

|

|||

Equity compensation plans approved by security holders |

|

|

|

|

|

|

|

|

|

|||

Inhibikase Therapeutics, Inc.2011 Equity Incentive Plan |

|

|

514,191 |

|

|

$ |

11.02 |

|

|

|

— |

|

Inhibikase Therapeutics, Inc. 2020 Equity Incentive Plan |

|

|

471,089 |

|

|

$ |

9.58 |

|

|

|

988,792 |

|

Equity compensation plans not approved by security holders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

TOTAL |

|

|

985,280 |

|

|

|

|

|

|

988,792 |

|

|

-13-

Remaining Share Reserve

As of April 15, 2024, there were 6,476,844 shares of our common stock outstanding. As of the date hereof, the Company has awarded grants of options and RSUs to purchase shares of our common stock and grants of restricted stock units settled in our common stock, in each case, pursuant to the Current Plan, with the number of shares of our common stock underlying such grants totaling 471,089 in the aggregate. There are 988,792 authorized shares that could be issued remaining under the Current Plan. The increase of the current share pool by 2,500,000 authorized shares of common stock to replenish the number of authorized shares of common stock available for future grants will result in additional potential dilution of our outstanding common stock if issued.

With respect to options or stock appreciation rights that expire, terminate or are canceled or forfeited for any reason without having been exercised in full, the shares of our common stock associated with such awards will again become available for grant under the Amended Plan.

Awards that are assumed or substituted by us in connection with an acquisition will not reduce the current share pool. In the event of any merger, consolidation, reorganization, recapitalization, stock split, reverse stock split, split up, spin-off, combination of shares, exchange of shares, stock dividend, dividend in kind or other like change in capital structure (other than ordinary cash dividends) to our stockholders, or other similar corporate event or transaction that affects our common stock, the compensation committee shall make appropriate adjustments in the number and kind of shares authorized by the Amended Plan and covered under outstanding awards as it determines appropriate and equitable.

Additionally, with respect to awards previously granted under our 2011 Equity Incentive Plan that expire, terminate, are canceled or are forfeited for any reason after the effective date of the Current Plan, the shares subject to such awards will be added to the current share pool so that they can be utilized for new grants under the Current Plan. As of April 15, 2024, awards with respect to 514,191 shares of our common stock were outstanding under our 2011 Equity Incentive Plan.

The term of the Current Plan will expire on December 22, 2030.

Summary of the Amended Plan

The principal provisions of the Amended Plan are summarized below. This summary is qualified in its entirety by reference to the actual Amended Plan, a copy of which is attached as Appendix A hereto.

Administration

The Amended Plan vests broad powers in a committee to administer and interpret the Amended Plan. The Board of Directors designated the compensation committee to administer the Amended Plan. Except when limited by the terms of the Amended Plan, the compensation committee has the authority to, among other things: select the persons to be granted awards; determine the type, size and term of awards; establish performance objectives and conditions for earning awards; determine whether such performance objectives and conditions have been met; and accelerate the vesting or exercisability of an award. In its discretion, the compensation committee may delegate all or part of its authority and duties with respect to granting awards to one or more of our officers, subject to certain limitations and provided applicable law so permits.

The Board of Directors may amend, alter or discontinue the Amended Plan and the compensation committee may amend any outstanding award at any time; provided, however, that no such amendment or termination may adversely affect awards then outstanding without the holder’s permission. In addition, any amendments seeking to increase the total number of shares reserved for issuance under the Amended Plan or modifying the classes of participants eligible to receive awards under the Amended Plan will require ratification by our stockholders in accordance with applicable law. Additionally, as described more fully below, neither the compensation committee nor the Board of Directors is permitted to reprice outstanding options or stock appreciation rights without shareholder consent.

Eligibility

Any of our employees, directors, consultants and other service providers, or those of our affiliates, will be eligible to participate in the Amended Plan. As of April 15, 2024, the Company employed or engaged approximately seven employees, four non-employee directors and four consultants who would be eligible to participate in the Amended Plan.

-14-

Vesting

The compensation committee determines the vesting conditions for awards. These conditions may include the continued employment or service of the participant, the attainment of specified individual or corporate performance goals, or other factors in the compensation committee’s discretion (collectively, “Vesting Conditions”).

Shares of Stock Available for Issuance

Subject to certain adjustments, the maximum number of shares of our common stock that may be issued under the Amended Plan in connection with awards is 3,959,881 (the “Amended Share Pool”). The number of shares in the Amended Share Pool is equal to the sum of the 471,089 grants issued under the 2020 Plan, the 988,792 shares that remain available for future grants under the 2020 Plan and the proposed increase of 2,500,000 shares to replenish the number of authorized shares of common stock available for future grants. However, if any award previously granted under our 2011 Equity Incentive Plan expires, terminates, is canceled or is forfeited for any reason after the effective date of the Amended Plan, the shares subject to that award will be added to the Amended Share Pool so that they can be utilized for new grants under the Amended Plan. As of April 15, 2024, awards with respect to 514,191 shares of our common stock were outstanding under our 2011 Equity Incentive Plan.

If any award granted under the Amended Plan expires, terminates, is canceled or is forfeited, the shares of our common stock underlying the award will be available for new grants under the Amended Plan. However, shares of our common stock that are withheld for the payment of taxes or in satisfaction of the exercise price for an option award will not become available for re-issuance under the Amended Plan.

Any shares of our common stock issued by the Company through the assumption or substitution of outstanding grants in connection with the acquisition of another entity will not reduce the Amended Share Pool.

The maximum total grant date fair value of awards granted under the Amended Plan to individuals in their capacity as non-employee directors may not exceed $250,000 in any single calendar year.

The market value of a share of our common stock was $2.195 as of April 15, 2024.

Adjustments

In the event of any merger, consolidation, reorganization, recapitalization, stock split, reverse stock split, split up, spin-off, combination of shares, exchange of shares, stock dividend, dividend in kind or other like change in capital structure (other than ordinary cash dividends) to stockholders of the Company, or other similar corporate event or transaction that affects our common stock, the compensation committee shall make adjustments to the number and kind of shares authorized by the Amended Plan and covered under outstanding awards as it determines appropriate and equitable.

Types of Awards

The following types of awards may be granted to participants under the Amended Plan: (i) incentive stock options (“ISOs”); (ii) nonqualified stock options (“NQOs” and together with ISOs, “options”); (iii) stock appreciation rights; (iv) restricted stock; or (v) restricted stock units (“RSUs”).

Stock Options. An option entitles the holder to purchase from us a stated number of shares of our common stock. An ISO may only be granted to our employees or the employees of our affiliates. The compensation committee will specify the number of shares of our common stock subject to each option and the exercise price for such option, provided that the exercise price may not be less than the fair market value of a share of our common stock on the date the option is granted. Notwithstanding the foregoing, if ISOs are granted to any 10% stockholder, the exercise price shall not be less than 110% of the fair market value of common stock on the date the option is granted.

Generally, options may be exercised in whole or in part through a cash payment. The compensation committee may, in its sole discretion, permit payment of the exercise price of an option in the form of previously acquired shares based on the fair market value of the shares on the date the option is exercised, through means of “net settlement,” which involves the cancellation of a portion of the option to cover the cost of exercising the balance of the option or by such other means as it deems acceptable.

-15-

All options shall be or become exercisable in accordance with the terms of the applicable award agreement. The maximum term of an option shall be determined by the compensation committee on the date of grant but shall not exceed 10 years (5 years in the case of ISOs granted to any 10% stockholder). In the case of ISOs, the aggregate fair market value (determined as of the date of grant) of common stock with respect to which such ISOs become exercisable for the first time during any calendar year cannot exceed $100,000. ISOs granted in excess of this limitation will be treated as non-qualified stock options.

Stock Appreciation Rights. A stock appreciation right represents the right to receive, upon exercise, any appreciation in a share of common stock over a particular time period. The base price of a stock appreciation right shall not be less than the fair market value of a share of our common stock on the date the stock appreciation right is granted. This award is intended to mirror the benefit the participant would have received if the compensation committee had granted the participant an option. The maximum term of a stock appreciation right shall be determined by the compensation committee on the date of grant but shall not exceed 10 years. Distributions with respect to stock appreciation rights may be made in cash, shares of our common stock, or a combination of both, at the compensation committee’s discretion.

Unless otherwise provided in an award agreement or determined by the compensation committee, if a participant terminates employment with us (or our affiliates) due to death or disability, the participant’s unexercised options and stock appreciation rights may be exercised, to the extent they were exercisable on the termination date, for a period of twelve months from the termination date or until the expiration of the original award term, whichever period is shorter. If the participant terminates employment with us (or our affiliates) for cause, (i) all unexercised options and stock appreciation rights (whether vested or unvested) shall terminate and be forfeited on the termination date, and (ii) any shares in respect of exercised options or stock appreciation rights for which we have not yet delivered share certificates will be forfeited and we will refund to the participant the option exercise price paid for those shares, if any. If the participant’s employment terminates for any other reason, any vested but unexercised options and stock appreciation rights may be exercised by the participant, to the extent exercisable at the time of termination, for a period of ninety days from the termination date (or such time as specified by the compensation committee at or after grant) or until the expiration of the original option or stock appreciation right term, whichever period is shorter. Unless otherwise provided by the compensation committee, any options and stock appreciation rights that are not exercisable at the time of termination of employment shall terminate and be forfeited on the termination date.

Restricted Stock. A restricted stock award is a grant of shares of our common stock, which are subject to forfeiture restrictions during a restriction period. The compensation committee will determine the price, if any, to be paid by the participant for each share of our common stock subject to a restricted stock award. The restricted stock may be subject to Vesting Conditions. If the specified Vesting Conditions are not attained, the participant will forfeit the portion of the restricted stock award with respect to which those conditions are not attained, and the underlying common stock will be forfeited to us. At the end of the restriction period, if the Vesting Conditions have been satisfied, the restrictions imposed will lapse with respect to the applicable number of shares. Unless otherwise provided in an award agreement or determined by the compensation committee, upon termination a participant will forfeit all restricted stock that then remains subject to forfeiture restrictions.

Restricted Stock Units. RSUs are granted in reference to a specified number of shares of our common stock and entitle the holder to receive, on the achievement of applicable Vesting Conditions, shares of our common stock. Unless otherwise provided in an award agreement or determined by the compensation committee, upon termination a participant will forfeit all RSUs that then remain subject to forfeiture.

Change in Control

In the event of a change in control, the compensation committee may, on a participant-by-participant basis: (i) cause any or all outstanding awards to become vested and immediately exercisable (as applicable), in whole or in part; (ii) cause any outstanding option or stock appreciation right to become fully vested and immediately exercisable for a reasonable period in advance of the change in control and, to the extent not exercised prior to that change in control, cancel that option or stock appreciation right upon closing of the change in control; (iii) cancel any unvested award or unvested portion thereof, with or without consideration; (iv) cancel any award in exchange for a substitute award; (v) redeem any restricted stock or restricted stock unit for cash and/or other substitute consideration with value equal to the fair market value of an unrestricted share on the date of the change in control; (vi) cancel any outstanding option or stock appreciation right with respect to all common stock for which the award remains unexercised in exchange for a cash payment equal to the excess (if any) of the fair market value of the common stock subject to the option or stock appreciation right over the exercise price of the option or stock appreciation right; (vii) impose vesting terms on cash or substitute consideration payable upon cancellation of an award

-16-

that are substantially similar to those that applied to the cancelled award immediately prior to the change in control, and/or earn-out, escrow, holdback or similar arrangements, to the extent such arrangements are applicable to any consideration paid to stockholders in connection with the change in control; (viii) take such other action as the compensation committee shall determine to be reasonable under the circumstances; and/or (ix) in the case of any award subject to Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), the compensation committee shall only be permitted to use discretion to alter the settlement timing of the award to the extent that such discretion would be permitted under Section 409A of the Code.

Repricing

Neither the Board of Directors nor the Compensation Committee may, without obtaining prior approval of our stockholders: (i) implement any cancellation/re-grant program pursuant to which outstanding options or stock appreciation rights under the Amended Plan are cancelled and new options or stock appreciation rights are granted in replacement with a lower exercise per share; (ii) cancel outstanding options or stock appreciation rights under the Amended Plan with an exercise price per share in excess of the then current fair market value per share for consideration payable in our equity securities; or (iii) otherwise directly reduce the exercise price in effect for outstanding options or stock appreciation rights under the Amended Plan.

Federal Income Tax Consequences

The federal income tax consequences arising with respect to grants awarded under the Amended Plan will depend on the type of grant. The following provides only a general description of the application of federal income tax laws to certain grants under the Amended Plan. This discussion is intended for the information of stockholders considering how to vote at the meeting and not as tax guidance to participants in the Amended Plan, as the consequences may vary with the types of grants made, the identity of the recipients and the method of payment or settlement. The summary does not address the effects of other federal taxes (including possible “golden parachute” excise taxes) or taxes imposed under state, local or foreign tax laws. Tax laws are subject to change.

Under the Code, as currently in effect, a grant under the Amended Plan of options, stock appreciation rights, restricted stock or RSUs would have no federal income tax consequence at the time of grant. Generally, all amounts taxable as ordinary income to participants under the Amended Plan in respect of awards are expected to be deductible by the Company as compensation at the same time the participant recognizes the ordinary income, subject to the limitations of Section 162(m) of the Code.

Options and Stock Appreciation Rights. Upon exercise of a nonqualified stock option, the excess of the fair market value of the stock at the date of exercise over the exercise price is taxable to a participant as ordinary income. Similarly, upon exercise of a Stock Appreciation Right, the value of the shares or cash received is taxable to the participant as ordinary income. Upon exercise of an ISO, the participant will not have taxable income, except that alternative minimum tax may apply. When there is a disposition of the shares subject to the ISO, provided that such disposition occurs at least two years after the date of ISO grant and at least one year after the date of exercise, the difference, if any, between the sale price of the shares and the exercise price of the option is treated as long-term capital gain or loss. If the participant does not satisfy these holding period requirements, a “disqualifying disposition” occurs, and the participant will recognize ordinary income in the year of the disposition in an amount equal to the excess of the fair market value of the shares at the time the option was exercised over the exercise price of the option. In that case, any gain realized in excess of the fair market value at the time of exercise will be short or long-term capital gain, depending on whether the shares were sold more than one year after the option was exercised.

Restricted Stock. Unless the participant elects to recognize its value as income at the time of the grant, by filing an election under Section 83(b) of the Code, restricted stock is taxable to a participant as ordinary income when it becomes vested.

Restricted Stock Units. When shares of our common stock or cash with respect to RSU awards are delivered to the participant, the value of the shares or cash is taxable to the participant as ordinary income.

Miscellaneous

Generally, awards granted under the Amended Plan shall be nontransferable except by will or by the laws of descent and distribution. The awards will be subject to our recoupment and stock ownership policies, as may be in effect from time to

-17-

time. Awards will be subject to applicable tax withholding requirements, and the compensation committee may authorize the withholding of shares subject to the award to satisfy required tax withholding. The Amended Plan will expire on December 22, 2030.

The Board of Directors deems Proposal No. 3 “Approval of an Amendment to the Company’s 2020 Equity Incentive Plan to Increase the Authorized Number of Shares of Common Stock Reserved for Issuance by 2,500,000 shares to replenish the number of authorized shares of common stock available for future grants” to be in our and our stockholders' best interests and unanimously recommends a vote “FOR” approval thereof.

-18-

PROPOSAL NO. 4

APPROVAL OF AN AMENDMENT TO ARTICLE XII OF OUR CERTIFICATE

OF INCORPORATION TO ELIMINATE THE 66 2/3% AFFIRMATIVE VOTE REQUIREMENT FOR AMENDMENTS TO SECTION 1 OF ARTICLE IV THEREOF

General

Article XII of our Certificate of Incorporation currently provides that the Board of Directors acting pursuant to a resolution adopted by a majority of the Board of Directors and the affirmative vote of sixty-six and two-thirds percent (66 2/3%) of the outstanding voting securities of the Company, voting together as a single class, shall be required for the amendment, repeal or modification of the provisions of Section 1, Section 2 and Section 3 of Article IV, Section 1 and Section 2 of Article V, Article VI, Section 5 of Article VII, Article VIII, Article XI or Article XII of our Certificate of Incorporation. Specifically, Section 1 of Article IV of our Certificate of Incorporation provides for the Company’s authorized capital stock.

Our Board of Directors is seeking stockholder approval of an amendment to our Certificate of Incorporation that would eliminate the requirement for the affirmative vote of 66 2/3% for the amendment, repeal or modification of the provisions of Section 1 of Article IV of our Certificate of Incorporation (the “Stockholder Vote Amendment”).

Section 1 of Article IV of our Certificate of Incorporation provides as follows:

Section 1. This Corporation is authorized to issue two classes of stock, to be designated, respectively, common stock and preferred stock. The total number of shares of stock that the Corporation shall have authority to issue is one hundred ten million (110,000,000) shares, of which one hundred million (100,000,000) shares are common stock, $0.001 par value, and ten million (10,000,000) shares are preferred stock, $0.001 par value.

We are seeking approval of the Stockholder Vote Amendment so that any proposed increase or decrease to the number of authorized shares of common stock or preferred stock could be enacted in accordance with the provisions of Section 242 (d)(2) of the Delaware General Corporation Law which requires that the votes cast by stockholders for such an increase or decrease exceed the votes cast by stockholders against the increase or decrease.

The proposed amendment would amend and restate Section 1 of Article XII of the Certificate of Incorporation as follows:

The Corporation reserves the right to amend or repeal any provision contained in this Amended and Restated Certificate of Incorporation in the manner prescribed by the laws of the State of Delaware and all rights conferred upon stockholders are granted subject to this reservation; provided, however, that notwithstanding any other provision of this Amended and Restated Certificate of Incorporation or any provision of law that might otherwise permit a lesser vote or no vote, the Board of Directors acting pursuant to a resolution adopted by a majority of the Board of Directors and the affirmative vote of sixty-six and two-thirds percent (66 2/3%) of the then outstanding voting securities of the Corporation, voting together as a single class, shall be required for the amendment, repeal or modification of the provisions of Section 2 and Section 3 of Article IV, Section 1 and Section 2 of Article V, Article VI, Section 5 of Article VII, Article VIII, Article XI or Article XII of this Amended and Restated Certificate of Incorporation.

The form of the proposed certificate of amendment to the Certificate of Incorporation is attached hereto as Appendix B.

Reasons for the Stockholder Vote Amendment

The Board of Directors is committed to ensuring effective corporate governance policies and practices, which ensure that the Company is governed in accordance with high standards of ethics, integrity and accountability and in the best interests of our stockholders. The Board of Directors has considered the advantages and disadvantages of maintaining the 66 2/3% voting provisions in our Certificate of Incorporation. The Board of Directors has considered this in light of any future amendments it may propose to increase or decrease the authorized number of shares of capital stock of the Company under Section 1 of Article IV. Upon review, the Board of Directors has determined that removing the 66 2/3% requirement with respect to amendments to the authorized number of shares of our capital stock is advisable and in the best interests of the

-19-

Company and our stockholders. An increase in the authorized number of shares of our capital stock would increase the flexibility of the Company to meet future financing and compensation needs, including raising capital through issuances of common stock or securities that are convertible into common stock, potential business expansion through strategic mergers, acquisitions, or other business combinations through issuances of common stock, establishing potential strategic relationships with other companies through the issuance of common stock, exchanges of common stock or securities that are convertible into common stock for other outstanding securities, providing equity incentives to attract and retain employees, officers or directors, and other purposes.

Potential Effects of the Vote Requirement Amendment

Following the Stockholder Vote Amendment, the requirement for future amendments to Section 1 of Article IV will be a resolution adopted by a majority of the Board of Directors and a stockholder vote in which votes cast by stockholders for such amendment which exceed the votes cast by stockholders against such amendment. Accordingly, the stockholder vote required to amend Section 1 of Article IV of the Certificate of Incorporation would no longer be 66 2/3% of the outstanding voting securities of the Company.

Potential Effects if the Vote Requirement Amendment is not Approved

If the Stockholder Vote Requirement is not approved, the stockholder vote required to amend Section 1 of Article IV of the Certificate of Incorporation would remain at 66 2/3% of the outstanding voting securities of the Company. Accordingly, it will remain more difficult for the Company to obtain the stockholder vote required to amend the capital structure to meet future financing and compensation needs of the Company in the future.

Implementation of the Vote Requirement Amendment

Following stockholder approval of this proposal, the Board of Directors will file a certificate of amendment with the Secretary of State of the State of Delaware.

The Board of Directors deems Proposal No. 4 "Approval of an Amendment to Article XII of our Certificate of Incorporation to Eliminate the 66 2/3% Affirmative Vote Requirement for Amendments to Section 1 of Article IV Thereof" to be in our and our stockholders' best interests and unanimously recommends a vote "FOR" approval thereof.

-20-

MANAGEMENT AND CORPORATE GOVERNANCE

Executive Officers and Directors

The following table sets forth the names, ages and positions of our executive officers and directors as of April 1, 2024:

Name |

|

Age |

|

|

Position |

|

Executive Officers: |

|

|

|

|

|

|

Milton H. Werner, Ph.D. |

|

|

61 |

|

|

President, Chief Executive Officer and Director |

Garth Lees-Rolfe, C.P.A. |

|

|

39 |

|

|

Chief Financial Officer |

Non-Employee Directors: |

|

|

|

|

|

|

Gisele Dion(1)(2)(4) |

|

|

57 |

|

|

Director |

Roy Freeman, M.D.(2)(3) |

|

|

72 |

|

|

Director |

Paul Grint, M.D.(1)(2)(3)(5) |

|

|

66 |

|

|

Director |