UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Inhibikase Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

INHIBIKASE THERAPEUTICS, INC.

3350 RIVERWOOD PARKWAY SE, SUITE 1900

ATLANTA, GEORGIA 30339

(678) 392-3419

May 5, 2023

Dear Fellow Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of Inhibikase Therapeutics, Inc. (“Inhibikase,” the “Company,” “we” or “us”) to be held at 9:30 a.m., Eastern Time, on Friday, June 23, 2023.

We are very pleased that this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast, with no physical in-person meeting. You will be able to virtually attend the 2023 Annual Meeting of Stockholders online and submit your questions during the meeting by visiting https://web.lumiagm.com/235841686, password inhibikase2023. You will also be able to vote your shares electronically at the annual meeting. You will not be able to attend the annual meeting in person.

We are pleased to use the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate from any location.

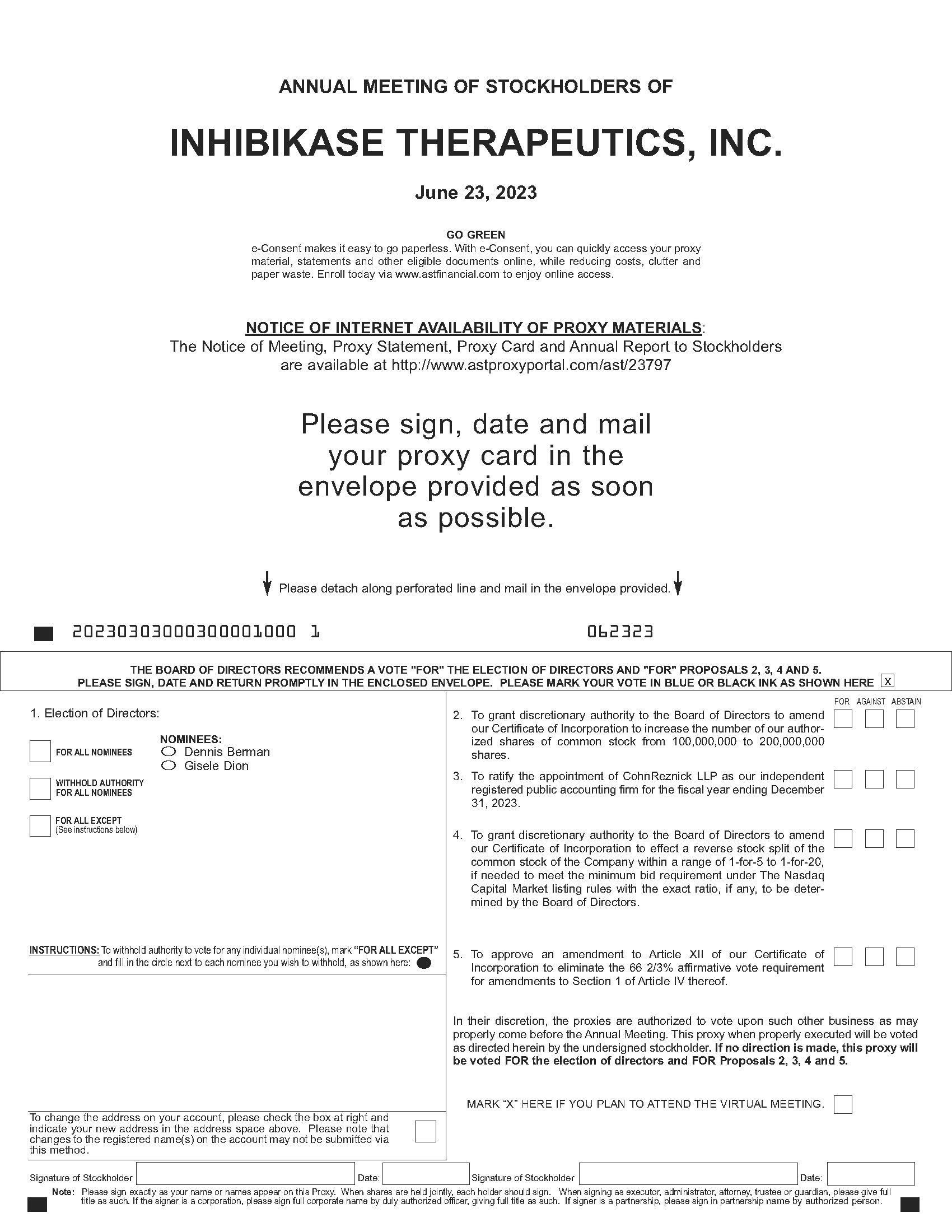

At the meeting, you will be asked to (i) elect two directors to the Board of Directors of the Company (“Board of Directors”) to serve as Class III directors, (ii) to grant discretionary authority to the Board of Directors to amend our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) to increase the number of authorized shares of common stock from 100,000,000 shares to 200,000,000 shares, (iii) to ratify our appointment of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, (iv) to grant discretionary authority to the Board of Directors to amend our Certificate of Incorporation to effect a reverse stock split of the common stock of the Company within a range of 1-for-5 to 1-for-20, if needed to meet the minimum bid requirement under The Nasdaq Capital Market (“Nasdaq”) listing rules with the exact ratio, if any, to be determined by the Board of Directors, and (v) to approve an amendment to Article XII of our Certificate of Incorporation to eliminate the 66 2/3% affirmative vote requirement for amendments to Section 1 of Article IV thereof. In addition, we will be pleased to report on our affairs and a discussion period will be provided for questions and comments of general interest to stockholders. Detailed information with respect to these matters is set forth in the accompanying Proxy Statement, which we encourage you to carefully read in its entirety.

We look forward to greeting personally those stockholders who are able to attend the meeting online. However, whether or not you plan to join us at the meeting, it is important that your shares be represented. Stockholders of record at the close of business on May 1, 2023 are entitled to notice of and to vote at the meeting. We will be using the “Notice and Access” method of providing proxy materials to you via the Internet. On or about May 12, 2023, we will mail to our stockholders a Notice of Availability of Proxy Materials (“Notice”) containing instructions on how to access our Proxy Statement and our 2022 Annual Report on Form 10-K and vote electronically via the Internet. The Notice also contains instructions on how to receive a printed copy of your proxy materials.

You may vote over the Internet, as well as by telephone or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. Please review the instructions for each of your voting options described in the Proxy Statement, as well as in the Notice you will receive in the mail.

Thank you for your ongoing support of Inhibikase.

Very truly yours, |

|

/s/ Milton H. Werner

|

Milton H. Werner, Ph.D. President and Chief Executive Officer |

INHIBIKASE THERAPEUTICS, INC.

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Inhibikase Therapeutics, Inc. (“Inhibikase” or the “Company”), will be held via live webcast on the Internet on Friday, June 23, 2023 at 9:30 a.m., Eastern Time, for the following purposes:

These matters are more fully described in the accompanying Proxy Statement.

You will be able to virtually attend the annual meeting, vote and submit your questions during the meeting by visiting https://web.lumiagm.com/235841686, password inhibikase2023 and entering the 11-digit control number included in the Notice of Internet Availability or proxy card that you receive. For further information about the virtual annual meeting, please see the section entitled “About the Annual Meeting” beginning on page 1 of the Proxy Statement.

Only stockholders of record at the close of business on May 1, 2023 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. We have decided that the Annual Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting. Stockholders will have the ability to attend, vote and submit questions before and during the virtual meeting from any location via the Internet at https://web.lumiagm.com/235841686, password inhibikase2023.

A complete list of these stockholders will be available in electronic form at the Annual Meeting and will be accessible for ten days prior to the Annual Meeting. All stockholders are cordially invited to virtually attend the Annual Meeting. On or about May 12, 2023, the Company will mail to stockholders a Notice of Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and our 2022 Annual Report on Form 10-K, how to vote electronically via the Internet or vote by telephone, and how to request printed proxy materials.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and submit your proxy or voting instructions as soon as possible by Internet, telephone or mail. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you will receive in the mail, the section entitled “About the Annual Meeting” beginning on page 1 of the Proxy Statement or, if you request to receive printed proxy materials, your enclosed proxy card. Please note that shares held beneficially in street name may be voted by you at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares.

Very truly yours, |

|

/s/ Milton H. Werner

|

Milton H. Werner, Ph.D. President and Chief Executive Officer |

Atlanta, Georgia

May 5, 2023

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders

To Be Held on June 23, 2023

The Proxy Statement, along with our 2022 Annual Report on Form 10-K, is available free of charge at the following website: http://www.astproxyportal.com/ast/23797.

Table of Contents

INHIBIKASE THERAPEUTICS, INC.

3350 RIVERWOOD PARKWAY SE, SUITE 1900

ATLANTA, GEORGIA 30339

PROXY STATEMENT

Our Board of Directors has made this Proxy Statement and related materials available to you on the Internet, or, upon your request, has delivered printed proxy materials to you by mail, in connection with the Board of Directors’ solicitation of proxies for use at the 2023 Annual Meeting of Stockholders of Inhibikase Therapeutics, Inc. to be held online on Friday, June 23, 2023, beginning at 9:30 a.m., Eastern Time, and at any postponements or adjournments of the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement.

ABOUT THE ANNUAL MEETING

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners as of the record date (for more information on the record date, see “– Who is entitled to vote at the Annual Meeting?”). The mailing of the Notice to our stockholders is scheduled to begin on or about May 12, 2023. All stockholders will have the ability to access the proxy materials and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) on a website referred to in the Notice or to request to receive a printed set of the proxy materials and the Annual Report. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. Stockholders may also request to receive proxy materials and our Annual Report in printed form by mail or electronically by email on an ongoing basis.

How do I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how you can:

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. Stockholders may also request to receive proxy materials and our Annual Report in printed form by mail or electronically by email on an ongoing basis. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting accompanying this Proxy Statement, consisting of (i) the election of two directors to the Board of Directors of the Company (the “Board of Directors”) to serve as the Class III directors; (ii) to grant discretionary authority to the Board of Directors to amend our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) to increase the number of authorized shares of common stock from 100,000,000 shares to 200,000,000 shares, (iii) to ratify our appointment of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, (iv) to grant discretionary authority to the Board of Directors to amend our Certificate of Incorporation to effect a reverse stock split of the common stock of the Company within a range of 1-for-5 to 1-for-20, if needed to meet the minimum bid requirement under Nasdaq listing rules with the exact ratio, if any, to be determined by the Board of Directors, (v) to approve an amendment to Article XII of our Certificate of Incorporation to eliminate the 66 2/3% affirmative vote requirement for amendments to Section 1 of Article IV thereof, and (vi) such other business that may properly come before the meeting or any postponement or adjournment thereof. In addition, management will report on our performance during the fiscal year ended December 31,

-1-

2022 and more recent developments and respond to questions from stockholders. Our Board of Directors is not currently aware of any other matters which will come before the meeting.

How do proxies work and how are votes counted?

The Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Annual Meeting in the manner you direct. You may vote for our director nominees or withhold your vote as to our director nominees. You may also vote for or against, or abstain from approving the proposed amendments to our Certificate of Incorporation or voting on the ratification of our selection of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. If a stockholder of record does not indicate instructions with respect to one or more matters on his, her or its proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors (for more information, see “– How does the Board of Directors recommend that I vote?”). If a beneficial owner of shares held in street name does not provide instructions to the bank, broker, or other nominee holding those shares, please see the information below under the caption “– What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on May 1, 2023, the record date for the meeting, are entitled to receive notice of and to participate in the Annual Meeting, or any postponements and adjournments of the meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponements or adjournments of the meeting.

On May 1, 2023, the record date for the meeting, there were 31,056,238 shares of common stock outstanding. Each outstanding share of common stock is entitled to one vote on each of the matters presented at the Annual Meeting or postponements and adjournments of the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock as of the record date will constitute a quorum, permitting the Annual Meeting to conduct its business. As of the record date, 31,056,238 shares of common stock, representing the same number of votes, were outstanding. Thus, the presence of holders representing at least 15,528,120 shares will be required to establish a quorum.

If a stockholder abstains from voting as to any matter or matters, the shares held by such stockholder shall be deemed present at the Annual Meeting for purposes of determining a quorum. If a bank, broker, or other nominee returns a “broker non-vote” proxy, indicating a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the bank, broker, or other nominee to vote on a particular matter, then the shares covered by such broker non-vote proxy shall be deemed present at the Annual Meeting for purposes of determining a quorum. For more information on discretionary and non-discretionary matters, see “– What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

What vote is required to approve each matter and how are votes counted?

Proposal No. 1: Election of Class III Directors

The two nominees who receive the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote on the election of directors will be elected as our Class III directors. Abstentions, broker non-votes and instructions on the accompanying proxy card to withhold authority to vote for one or more nominees will not be counted as votes in favor of the relevant nominee or nominees and will result in the relevant nominee or nominees receiving fewer total votes. However, the number of votes cast in favor of such nominee will not be reduced by any abstention, broker non-vote or instructions to withhold authority.

Proposal No. 2: Grant Discretionary Authority to the Board of Directors to Amend our Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock from 100,000,000 Shares to 200,000,000 Shares

-2-

The affirmative vote of the holders of 66 2/3% of the issued and outstanding shares of the Company's common stock entitled to vote is required for the approval of this proposal. An abstention from voting by a stockholder or a broker non-vote by a broker who elects to non-vote instead of using its discretion to vote on this proposal has the same legal effect as a vote “against” the matter.

Proposal No. 3: Ratification of Appointment of Independent Registered Public Accounting Firm

The affirmative vote of a majority of the issued and outstanding shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting by a stockholder present in person or represented by proxy at the meeting or a broker non-vote by a broker who elects to non-vote instead of using its discretion to vote has the same legal effect as a vote “against” the matter.

Proposal No. 4: Grant Discretionary Authority to the Board of Directors to Amend our Certificate of Incorporation to Effect a Reverse Stock Split of the Common Stock of the Company Within a Range of 1-for-5 to 1-for-20, If Needed to Meet the Minimum Bid requirement under Nasdaq Listing Rules with the Exact Ratio, If Any, To Be Determined by the Board of Directors

The affirmative vote of a majority of the issued and outstanding shares of our common stock entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting by a stockholder or a broker non-vote by a broker who elects to non-vote instead of using its discretion to vote has the same legal effect as a vote “against” the matter.

Proposal No. 5: Approval of an Amendment to Article XII of our Certificate of Incorporation to Eliminate the 66 2/3% Affirmative Vote Requirement for Amendments to Section 1 of Article IV Thereof

The affirmative vote of the holders of 66 2/3% of the issued and outstanding shares of our common stock entitled to vote on this proposal is required for the approval of this proposal. An abstention from voting by a stockholder or a broker non-vote has the same legal effect as a vote “against” the matter.

How can you attend the Annual Meeting?

We will be hosting the Annual Meeting live via audio webcast. Any stockholder can attend the Annual Meeting live online at https://web.lumiagm.com/235841686, password inhibikase2023. If you were a stockholder as of the record date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

To attend and participate in the Annual Meeting, you will need the 11-digit control number included in the Notice, on your proxy card, or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 11-digit control number or otherwise vote through the bank or broker. If you lose your 11-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the record date.

Why hold a virtual meeting?

We are excited to use the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. We believe the virtual meeting format enables increased stockholder attendance and participation because stockholders can participate from any location around the world.

-3-

How do I ask questions at the virtual Annual Meeting?

During the virtual Annual Meeting, you may only submit questions in the question box provided at https://web.lumiagm.com/235841686, password inhibikase2023. We will respond to as many inquiries at the virtual Annual Meeting as time allows.

What if during the check-in time or during the virtual Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting website log-in page.

How can I vote my shares?

Record Owners and Beneficial Owners Who Have Been Provided With a 11 Digit Control Number

If you are a record holder, meaning your shares are registered in your name and not in the name of a broker, trustee, or other nominee, or a beneficial owner who has been provided by your broker with an 11 digit control number, you may vote:

1. Over the Internet – If you have Internet access, you may authorize the voting of your shares by accessing www.voteproxy.com and following the instructions set forth in the Proxy Materials. You must specify how you want your shares voted or your vote will not be completed and you will receive an error message. Your shares will be voted according to your instructions. You can also vote during the meeting by visiting https://web.lumiagm.com/235841686, password inhibikase2023 and having available the 11 digit control number included on your proxy card or on the instructions that accompanied your Proxy Materials.

2. By Telephone – If you are a registered stockholder, you may call toll-free 1-800-PROXIES (1-800-776-9437) to vote by telephone. If you are a beneficial owner who has been provided with a control number on the voting instruction form that accompanied your Proxy Materials, you may call toll-free 1-800-PROXIES (1-800-776-9437) to vote by telephone. Your shares will be voted according to your instructions.

3. By Mail If You Are a Record Owner – Complete and sign the attached WHITE proxy card and mail it in the enclosed postage prepaid envelope. Your shares will be voted according to your instructions. If you sign your WHITE proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. Unsigned proxy cards will not be voted.

Beneficial Owners

As the beneficial owner, you have the right to direct your broker, trustee, or other nominee on how to vote your shares. In most cases, when your broker provides you with proxy materials, they will also provide you with an 11 digit control number, which will allow you to vote as described above or at the Annual Meeting. If your broker has not provided you with an 11 digit control number, please contact your broker for instructions on how to vote your shares.

Stockholders who submit a proxy by Internet or telephone need not return a proxy card or any form forwarded by your broker, bank, trust or nominee. Stockholders who submit a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or telephone, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder.

What am I voting on at the Annual Meeting?

The following proposals are scheduled for a vote at the Annual Meeting:

-4-

Each of these proposals is described in further detail below.

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not currently aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Dr. Milton Werner, Chief Executive Officer, and Joseph Frattaroli, Chief Financial Officer will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxies will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

How does the Board of Directors recommend that I vote?

As to the proposals to be voted on at the Annual Meeting, the Board of Directors unanimously recommends that you vote:

What if I am a stockholder of record and do not indicate voting instructions on my proxy?

If you are a stockholder of record and provide specific instructions on your proxy with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated on your proxy for one or more of the proposals to be voted on, the shares will be voted as recommended by the Board of Directors: (i) in favor of our Class III director nominees, (ii) to grant discretionary authority to the Board of Directors to amend our Certificate of Incorporation to increase the number of authorized shares of common stock from 100,000,000 shares to 200,000,000 shares, (iii) for the ratification of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, (iv) to grant discretionary authority to the Board of Directors to amend our Certificate of Incorporation to effect a reverse stock split of the common stock of the Company within a range of 1-for-5 to 1-for-20, if needed to meet the minimum bid requirement under Nasdaq listing rules with the exact ratio, if any, to be determined by the Board of Directors, and (v) to approve an amendment to Article XII of our Certificate of Incorporation to eliminate the 66 2/3% affirmative vote requirement for amendments to Section 1 of Article IV thereof. If any other matters are properly presented for consideration at the meeting, the individuals named as proxy holders, Dr. Milton Werner and Joseph Frattaroli, will vote the shares that

-5-

they represent on those matters as recommended by the Board of Directors. If the Board of Directors does not make a recommendation, then they will vote in accordance with their best judgment.

What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?

As a beneficial owner, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your bank, broker, or other nominee by the deadline provided in the materials you receive from your bank, broker, or other nominee or vote by mail, telephone or Internet according to instructions provided by your bank, broker, or other nominee. If you do not provide voting instructions to your bank, broker, or other nominee, whether your shares can be voted by such person or entity depends on the type of item being considered for vote.

We encourage you to provide instructions to your broker regarding the voting of your shares.

Can I change my vote or revoke my proxy?

Yes. (1) If you are a stockholder of record, you may revoke your proxy by (i) following the instructions on the Notice and entering a new vote by telephone or over the Internet up until 11:59 P.M. Eastern Time on June 22, 2023, (ii) attending the Annual Meeting and voting (although attendance at the Annual Meeting will not in and of itself revoke a proxy) or (iii) entering a new vote by mail. Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the holding of the vote at the Annual Meeting at 9:30 a.m., Eastern Time, on June 23, 2023. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or sent to the Company’s principal executive offices at 3350 Riverwood Parkway SE, Suite 1900, Atlanta, Georgia 30339, Attention: Corporate Secretary; (2) If a broker, bank, or other nominee holds your shares, you must contact them in order to find out how to change your vote.

The last proxy or vote that we receive from you will be the vote that is counted.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting.

Who will bear the cost of soliciting votes for the Annual Meeting?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We have engaged Kingsdale Shareholder Services US LLC (“Kingsdale Advisors”) to assist in soliciting proxies on our behalf. Kingsdale Advisors may solicit proxies personally, electronically or by telephone. We have agreed to pay Kingsdale Advisors a fee of $10,000 plus $4.50 per telephone call and $6.00 per QuickVote received for its services. QuickVote is a service that allows Kingsdale Advisers to record the votes of certain of our stockholders. We have also agreed to reimburse Kingsdale Advisors for its reasonable out-of-pocket expenses and to indemnify Kingsdale Advisors and its employees against certain liabilities arising from or in connection with the engagement.

-6-

What is “householding” and where can I get additional copies of proxy materials?

For information about householding and how to request additional copies of proxy materials, please see the section captioned “Householding of Proxy Materials.”

Whom may I contact if I have other questions about the Annual Meeting or voting?

You may contact the Company at 3350 Riverwood Parkway SE, Suite 1900, Atlanta, Georgia 30339, Attention: Milton H. Werner, Ph.D., or by telephone at (678) 392-3419. You may also contact Kingsdale Advisors by telephone at 1-855-682-9644.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. Voting results will be disclosed on a Form 8-K filed with the SEC within four business days after the Annual Meeting, which will also be available on our website.

We encourage you to vote by proxy over the Internet or by telephone by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided on the proxy card.

-7-

PROPOSAL NO. 1

ELECTION OF CLASS III DIRECTORS

Two directors are to be elected at the Annual Meeting to serve as our Class III directors until the Company’s 2026 annual meeting of stockholders, or until in each case their respective successor is duly elected and qualified. The Class III director nominees are current directors and have been nominated for re-election by our Board of Directors. The Company intends that the proxy in the form presented will be voted, unless otherwise indicated, for the election of the Class III director nominees to serve until the 2026 annual meeting of stockholders, or until in each case their respective successor is duly elected and qualified. Our Certificate of Incorporation provides that the number of directors that constitute the entire Board of Directors shall be determined in the manner designated in the Company’s bylaws. The Company’s Amended and Restated Bylaws provide that the number of directors is determined by resolution of the Board of Directors, provided that the Board of Directors shall consist of at least one member.

Should the Class III director nominees be unable to accept nomination or election as directors, the individuals named as proxy holders, Dr. Milton Werner and Joseph Frattaroli, will vote the shares that they represent for such other persons as the Board of Directors may recommend. The Board of Directors has no present knowledge that the Class III director nominees named below will be unavailable to serve.

The Class III directors standing for re-election, together with their age and certain other information, is:

Director

|

Age

|

Year First

|

Principal Occupation and Other Board of Directors Service

|

Dennis Berman |

72 |

2020 |

Dennis Berman has served as a member of our Board of Directors since December 22, 2020. Dennis Berman has been a co-founder, board member, and seed investor in many private biotechnology and technology companies, five of which have gone public. Currently, Mr. Berman is President of Molino Ventures, a board advisory and venture capital firm focused on privately held and publicly held health care and technology companies in all stages of development. Previously, he was Co-founder and Executive Vice President of Corporate Development of Tocagen Inc., a publicly traded gene therapy company utilizing a replicating retrovirus and prodrug to activate patients’ immune systems against their cancers. Other public companies for which Mr. Berman has served as a seed investor, co-founder, and/or board member include Intervu Inc. (one of the first software-as-a-service companies), which was acquired by Akamai Technologies Inc.; Kintera, Inc. (online fundraising pioneer), which was acquired by Blackbaud, Inc.; Gensia Pharmaceuticals, Inc. (focused on purine/pyrimidine metabolism compounds), which was acquired by Teva Pharmaceutical Industries Limited; and Viagene Biotech Inc. (the first U.S. gene therapy company, which utilized a non- replicating retrovirus), which was acquired by Chiron Corporation/Novartis AG. In addition, he was co-founder of Genovo Inc. (a private gene therapy company founded by James Wilson at the University of Pennsylvania). Mr. Berman also was a seed investor in Calabrian Corporation (a private water treatment company), which was acquired by SK Capital Partners. Earlier, Mr. Berman was a corporate law partner at several large law firms, including Sonnenschein Nath & Rosenthal LLP (now Dentons US LLP) and Reavis & McGrath (now Norton Rose Fulbright US LLP). Mr. Berman holds a Bachelor of Science from Wharton School in Accounting/ Economics and a Bachelor of Arts from the University of Pennsylvania in Economics and is a graduate of Harvard Law School. He has been an Entrepreneur in Residence at Harvard’s Innovation Lab (i-lab) and a guest speaker at Harvard School of Public Health. We believe Mr. Berman’s skills in corporate governance, corporate finance, and value creation in early and late stage pharmaceutical and biotechnology companies make him uniquely qualified to serve on our Board of Directors. |

|

|

|

|

Gisele Dion |

56 |

2022 |

Gisele Dion has served as a member of the Board of Directors since September 1, 2022. Ms. Dion is the former Chief Accounting Officer and Corporate Controller at Takeda Pharmaceutical Ltd. (“Takeda”). She also served as Senior Advisor to the Chief Financial Officer of Takeda. Prior to Takeda’s acquisition of Shire Pharmaceuticals |

-8-

|

|

|

LLC, Ms. Dion was the Senior Vice President, Chief Accounting Officer and Corporate Controller at Shire Pharmaceuticals LLC (“Shire”), a biopharmaceutical company. Previous to Shire, Ms. Dion served as Corporate Controller and Senior Director of Technical Accounting at Biogen Inc., a biotechnology company. Ms. Dion currently serves on the board of Cytek Biosciences, Inc. where she is Chair of its Audit Committee. Her prior experience includes serving as a staff member of the Financial Accounting Standards Board (FASB) and she has served as an Audit Advisor Group Member for the Pharmaceutical Research and Manufacturers of America (PhRMA). Ms. Dion received a B.S. in Accounting and Management Information Systems from Fairfield University. We believe Ms. Dion’s skills in corporate governance and corporate finance in early and late stage pharmaceutical and biotechnology companies makes her uniquely qualified to serve on our Board of Directors. |

No family relationships exist between any director, executive officer or person nominated or chosen to be a director or officer.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially own more than 10% of a registered class of our common stock, to file initial reports of ownership and reports of changes in ownership with the SEC. These officers, directors and stockholders are required by SEC regulations to furnish us with copies of all reports that they file.

Based solely upon a review of copies of the reports furnished to us during the year ended December 31, 2022 and thereafter, or any written representations received by us from directors, officers and beneficial owners of more than 10% of our common stock (“reporting persons”) that no other reports were required, we believe that all reporting persons filed on a timely basis all reports required by Section 16(a) of the Exchange Act during the year ended December 31, 2022.

Vote Required

The two Class III director nominees who receive the highest number of affirmative votes of the shares present in person or represented by proxy and entitled to vote on the election of directors will be elected as our Class III directors. Abstentions, broker non-votes and instructions on the accompanying proxy card to withhold authority to vote for one or more nominees will not be counted as votes in favor of the relevant nominee or nominees and will result in the relevant nominee or nominees receiving fewer total votes. However, the number of votes cast in favor of such nominees will not be reduced by any abstention, broker non-vote or instructions to withhold authority. The Company intends that the proxy in the form presented will be voted, unless otherwise indicated, for the election of the Class III director nominees. In the absence of instructions to the contrary, the shares represented by the accompanying proxy card will be voted “FOR” the Class III director nominees named above.

The Board of Directors unanimously recommends a vote “FOR” the election of

the Class III director nominees to the Board of Directors named in this Proposal No. 1.

-9-

PROPOSAL NO. 2

GRANT DISCRETIONARY AUTHORITY TO THE BOARD OF DIRECTORs TO AMEND our CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

General

Our Board of Directors is seeking stockholder authorization to grant discretionary authority to the Board of Directors to amend our Certificate of Incorporation to increase the number of authorized shares of common stock from 100,000,000 to 200,000,000 shares at any time prior to the one-year anniversary date of the Annual Meeting. The form of the proposed certificate of amendment to the Certificate of Incorporation is attached hereto as Appendix A.

The newly authorized shares of common stock would have the same rights as the currently outstanding shares of our common stock. As of May 1, 2023, 31,056,238 shares of our common stock were issued and outstanding, 4,826,208 shares were subject to outstanding option unit awards, 19,395,517 shares were subject to outstanding warrants and 7,067,892 shares of our common stock were reserved for future issuance under our equity compensation plans. Accordingly, 55,277,963 of the 100,000,000 authorized shares of our common stock are currently issued or reserved while 44,722,037 of the authorized shares of our common stock remain available for future issuance.

Even if the shareholders approve this proposal, we reserve the right not to effect the increase to the number of authorized shares of our common stock if the Board of Directors does not deem it to be in the best interests of our shareholders. The Board of Directors believes that granting this discretion provides the Board of Directors with maximum flexibility to act in the best interests of our shareholders. If this proposal is approved by the shareholders, the Board of Directors will have the authority, in its sole discretion, without further action by the shareholders, to effect the increase to the number of authorized shares of our common stock during the period set forth above.

The proposed amendment would amend and restate Section 1 of Article IV of the Certificate of Incorporation as follows:

This Corporation is authorized to issue two classes of stock, to be designated, respectively, Common Stock and Preferred Stock. The total number of shares of stock that the Corporation shall have authority to issue is two hundred ten million (210,000,000) shares, of which two hundred million (200,000,000) shares are Common Stock, $0.001 par value, and ten million (10,000,000) shares are Preferred Stock, $0.001 par value.

Reasons for the Increase in Authorized Shares

Our Board of Directors believes it would be prudent and advisable to have the additional shares of common stock available to provide additional flexibility regarding the potential use of shares of common stock for business and financial purposes in the future. Having an increased number of authorized but unissued shares of common stock would allow us to take prompt action with respect to corporate opportunities that may develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in our authorized shares. The additional shares could be used for various purposes without further stockholder approval. These purposes may include: (i) raising capital through issuances of common stock or securities that are convertible into common stock; (ii) potential business expansion through strategic mergers, acquisitions, or other business combinations through issuances of common stock; (iii) establishing potential strategic relationships with other companies through the issuance of common stock; (iv) exchanges of common stock or securities that are convertible into common stock for other outstanding securities; (v) providing equity incentives to attract and retain employees, officers or directors; and (vi) other purposes. We have no current plan, commitment, arrangement, understanding or agreement regarding the issuance of the additional shares of common stock that would result from the proposed amendment.

Potential Effects of the Proposed Amendment

The additional shares of our common stock to be authorized by adoption of the proposed amendment would have rights identical to our currently outstanding shares of common stock. Adoption of the proposed amendment and subsequent issuance of the shares of common stock would not affect the rights of the holders of our currently outstanding shares of common stock, except for effects incidental to increasing the number of shares of our common stock. Incidental effects of a subsequent issuance of shares of our common stock (but not of the adoption of the proposed amendment in and of itself) include potentially diluting the voting power and percentage ownership of existing stockholders. Current holders of shares of

-10-

our common stock do not have preemptive or similar rights, which means that current stockholders do not have a prior right to purchase any new issue of our capital stock, including shares of our common stock, in order to maintain their proportionate ownership of our company. If the proposed amendment is approved, our Board of Directors may cause the issuance of additional shares of our common stock without further vote of our stockholders, except as provided under Delaware or other applicable law, our charter or bylaws or under the listing rules of Nasdaq. Our Certificate of Incorporation also currently authorizes the issuance of 10,000,000 shares of preferred stock, none of which are issued or outstanding.

The proposed amendment to the Certificate of Incorporation would not change the authorized number of shares of preferred stock. Future issuances of shares of common stock or securities convertible into shares of common stock could have a dilutive effect on our earnings per share, book value per share and the voting interest and power of current stockholders since holders of common stock are not entitled to preemptive rights.

Although we have not proposed the increase in the number of authorized shares of common stock with the intent of using the additional shares to prevent or discourage any actual or threatened takeover of the Company, under certain circumstances, such shares could have an anti-takeover effect. The additional shares could be issued to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company or could be issued to persons allied with the Board of Directors or management and thereby have the effect of making it more difficult to remove directors or members of management by diluting the stock ownership or voting rights of persons seeking to effect such a removal. Accordingly, if the proposed amendment is approved and implemented, the additional shares of authorized common stock may render more difficult or discourage a merger, tender offer or proxy contest, the assumption of control by a holder of a large block of common stock, or the replacement or removal of members of the Board of Directors (as the Company’s Board of Directors is classified, directors may only be removed for cause) or management. Our Board of Directors and executive officers have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of the Company's common stock.

Potential Effects if the Proposed Amendment is not Approved

If the proposed amendment is not approved by our stockholders, our business development and financing alternatives will be limited by the amount of unissued and unreserved authorized shares of common stock, and stockholder value may be harmed by this limitation. In addition, our success depends in part on our continued ability to attract, retain and motivate highly qualified management and clinical and scientific personnel, and if the amendment is not approved by our stockholders, the lack of sufficient unissued and unreserved authorized shares of common stock to provide future equity incentive opportunities that our Compensation Committee deems appropriate could adversely impact our ability to achieve these goals. In summary, if our stockholders do not approve the amendment, we may not be able to access the capital markets, initiate or complete clinical trials and other key development activities, complete corporate collaborations or partnerships, conduct strategic business development initiatives, add to our product pipeline, attract, retain and motivate employees and others required to make our business successful, and pursue other business opportunities integral to our growth and success, all of which could severely harm our company and our future prospects.

Implementation of the Authorized Share Increase

Following stockholder approval of this proposal, the authorized share increase would be implemented by our filing the certificate of amendment with the Secretary of State of the State of Delaware. However, at any time prior to the effectiveness of the filing of the certificate of amendment with the Secretary of State of the State of Delaware, the Board of Directors reserves the right to abandon this proposal and to not file the certificate of amendment, even if approved by the stockholders of the Company, if the Board of Directors, in its discretion, determines that such amendment is no longer in the best interests of the Company or its stockholders. The Board of Directors currently expects that if the Reverse Stock Split described in Proposal 4 is implemented, the amendment to our Certificate of Incorporation for the authorized share increase will not be implemented.

Vote Required

The affirmative vote of the holders of 66 2/3% of the issued and outstanding shares of the Company's common stock entitled to vote is required for the approval of this proposal. An abstention from voting by a stockholder or a broker non-vote by a broker who elects to non-vote instead of using its voting discretion has the same legal effect as a vote “against” the matter. Generally, brokers, banks and other nominees that do not receive voting instructions from beneficial owners may vote on this proposal in their discretion.

-11-

The Board of Directors deems Proposal No. 2 "Grant Discretionary Authority to the Board of Directors to Amend our Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock from 100,000,000 Shares to 200,000,000 Shares" to be in our and our stockholders' best interests and unanimously recommends a vote "FOR" approval thereof.

-12-

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee of the Board of Directors has appointed CohnReznick LLP (“CohnReznick,” the “principal accountant” or the “independent accountant”) as the independent registered public accounting firm to audit our consolidated financial statements as of and for the fiscal year ending December 31, 2023. CohnReznick has been our independent registered public accounting firm since it was appointed in April 2018 to audit our consolidated financial statements for the fiscal year ended December 31, 2016. Since that date, CohnReznick has also provided us certain tax and other audit-related services. The Board of Directors has directed that management submit the selection of our independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Representatives of CohnReznick are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions. Notwithstanding its selection, the Board of Directors, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the Board of Directors believes that such a change would be in our and our stockholders’ best interests. If the appointment is not ratified by our stockholders, the Board of Directors may reconsider whether it should appoint another independent registered public accounting firm.

Audit and Other Fees

The following table sets forth the aggregate fees billed by CohnReznick LLP in connection with audit and other services rendered during the past two fiscal years.

|

|

12/31/2022 |

|

|

12/31/2021 |

|

||

Audit Fees(1) |

|

$ |

238,900 |

|

|

$ |

232,900 |

|

Audit-Related Fees(2) |

|

|

40,145 |

|

|

|

29,800 |

|

Tax Fees(3) |

|

|

23,000 |

|

|

|

— |

|

All other fees |

|

|

— |

|

|

|

— |

|

Total |

|

$ |

302,045 |

|

|

$ |

262,700 |

|

-13-

Audit Committee Report

The audit committee of the Board of Directors (the “audit committee”) operates under a written charter approved by the Board of Directors, which provides that its responsibilities include assisting the Board of Directors in monitoring the integrity of the Company’s financial statements, the qualifications and independence of the Company’s independent auditors, the performance of the Company’s internal audit function and independent auditors and the compliance by the Company with legal and regulatory requirements. For more information on the audit committee, see “Management and Corporate Governance – Board of Directors Committees – Audit Committee.”

The audit committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s internal controls, financial reporting process, and compliance with laws and regulations and ethical business standards. CohnReznick was responsible for performing an independent audit of the Company’s consolidated financial statements for the fiscal year ended December 31, 2022 in accordance with the standards of the Public Company Accounting Oversight Board of Directors (United States) (the “PCAOB”). The audit committee’s main responsibility is to monitor and oversee this process.

The audit committee reviewed and discussed our audited consolidated financial statements as of and for the fiscal year ended December 31, 2022 with management. The audit committee discussed with CohnReznick the matters required to be discussed by PCAOB Auditing Standard No. 16. The audit committee has received the written disclosures and the letter from the independent accountant required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

The audit committee is responsible to consider any fees paid to CohnReznick for the provision of non-audit related services. All non-audit related services rendered by CohnReznick for the fiscal years ended December 31, 2022 and December 31, 2021 were approved by the audit committee.

Based on the review and discussions referred to above in this report, the audit committee recommended to the Board of Directors that such audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 for filing with the SEC.

-14-

THE AUDIT COMMITTEE

Gisele Dion (Chairperson)

Paul Grint, M.D.

Dennis Berman

Audit Committee Pre-Approval Policies and Procedures

The audit committee is responsible for appointing, retaining, setting compensation for, and evaluating and overseeing the work of the independent registered public accounting firm. The audit committee’s charter establishes a policy that all audit and permissible non-audit services provided by the independent registered public accounting firm will be pre-approved by the audit committee.

All such audit and permissible non-audit services were pre-approved in accordance with this policy during the fiscal year ended December 31, 2022. These services may include audit services, audit-related services, tax services and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our independent registered public accounting firm. The responsibility to pre-approve audit and non-audit services may be delegated by the audit committee to one or more members of the audit committee; provided that any decisions made by such member or members must be presented to the full audit committee at its next scheduled meeting.

Vote Required

The affirmative vote of a majority of the outstanding shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required for the ratification of the appointment of CohnReznick as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Abstentions will be considered in determining the total number of votes required to attain a majority of the shares present in person or represented by proxy at the meeting entitled to vote. Accordingly, an abstention from voting by a stockholder present in person or represented by proxy at the meeting has the same legal effect as a vote “against” the matter because it represents a share present in person or represented by proxy at the meeting and entitled to vote, thereby increasing the number of affirmative votes required to approve this proposal. The ratification of the appointment of CohnReznick as our independent registered public accounting firm for the fiscal year ending December 31, 2023 is a discretionary item. Brokers, banks, and other nominees that do not receive voting instructions from beneficial owners of our common stock may generally vote on this proposal in their discretion. A broker non-vote by a broker who elects to non-vote instead of using its discretion to vote will have the same effect as a vote “against” the matter. The Company intends that the proxy in the form presented will be voted, unless otherwise indicated, for the ratification of CohnReznick as our auditors for the fiscal year ending December 31, 2023. If no instructions are indicated on such proxy, the shares will be voted “FOR” the ratification of CohnReznick as our auditors for the fiscal year ending December 31, 2023.

The Board of Directors deems Proposal No. 3 “Ratification of Appointment of

Independent Registered Accounting Firm” to be in our and our stockholders’

best interests and unanimously recommends a vote

“FOR” approval thereof.

-15-

PROPOSAL NO.4

GRANT DISCRETIONARY AUTHORITY TO THE BOARD OF DIRECTORS TO AMEND OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT of the common stock OF THE COMPANY within a range of 1-for-5 to 1-for-20, IF NEEDED TO MEET THE MINIMUM BID REQUIReMENT UNDER NASDAQ LISTING RULES, with the exact ratio, if any, to be determined by the Board of Directors

Introduction

At the Annual Meeting, stockholders will be asked to grant discretionary authority to the Board of Directors to amend our Certificate of Incorporation (the “Reverse Split Amendment”) to effect a reverse stock split of the common stock of the Company within a range of 1-for-5 to 1-for-20 (the “Reverse Stock Split”), if needed to meet the minimum bid requirement under The Nasdaq Capital Market (“Nasdaq”) listing rules with the exact ratio, if any, to be determined by the Board of Directors (the “Reverse Stock Split Ratio”) at any time prior to the one-year anniversary date of the Annual Meeting. Upon the effectiveness of the Reverse Split Amendment (the “Split Effective Time”), the issued shares of common stock outstanding immediately prior to the Split Effective Time will be reclassified into a smaller number of shares. The ultimate Reverse Stock Split Ratio will be based on a number of factors, including market conditions, existing and expected trading prices for the common stock and the listing requirements of Nasdaq. The form of the Reverse Split Amendment, as more fully described below, will effect the Reverse Stock Split but will not change the number of authorized shares of common stock or preferred stock, or the par value of the common stock or preferred stock. The following discussion is qualified in its entirety by the full text of the Reverse Split Amendment, which is incorporated herein by reference.

Even if the shareholders approve the Reverse Stock Split, we reserve the right not to effect the Reverse Stock Split if the Board of Directors does not deem it to be in the best interests of our shareholders. The Board of Directors believes that granting this discretion provides the Board of Directors with maximum flexibility to act in the best interests of our shareholders. If this Reverse Stock Split is approved by the shareholders, the Board of Directors will have the authority, in its sole discretion, without further action by the shareholders, to effect the Reverse Stock Split within the ratios and during the period set forth above.

The Board of Directors’ decision as to whether and when to effect the Reverse Stock Split will be based on a number of factors, including prevailing market conditions, existing and expected trading prices for our common stock, Nasdaq listing requirements, actual or forecasted results of operations, and the likely effect of such results on the market price of our common stock.

The form of the proposed certificate of amendment to the Certificate of Incorporation is attached hereto as Appendix B.

Purpose

The Board of Directors approved the proposal approving the Reverse Split Amendment for the following reasons:

Reasons for the Reverse Stock Split and Nasdaq Listing Requirements

Our common stock is listed on Nasdaq under the symbol “IKT”. For our common stock to continue to be listed on Nasdaq, we must meet the current continued listing requirements, including the requirement under Nasdaq Listing Rule 5550(a) that our common stock maintain a minimum bid price per share of at least $1.00 per share (the “Minimum Bid Price Requirement”).

-16-

On January 24, 2023 and July 25, 2022, we received written notices from the Listing Qualifications Department of Nasdaq notifying us that we are not in compliance with the Minimum Bid Price Requirement. On January 24, 2023, the Company received notice from Nasdaq indicating that, while the Company has not regained compliance with the Minimum Bid Price Requirement, Nasdaq has determined that the Company is eligible for an additional 180-day period, or until July 24, 2023, to regain compliance. According to the notice from Nasdaq, the Staff’s determination was based on (i) the Company meeting the continued listing requirement for the market value of its publicly held shares and all other Nasdaq initial listing standards, with the exception of the Minimum Bid Price Requirement, and (ii) the Company’s written notice to Nasdaq of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary. If at any time during this second 180-day compliance period, the closing bid price of the common stock is at least $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide the Company with written confirmation of compliance.

If compliance cannot be demonstrated by July 24, 2023, we expect that Nasdaq will provide written notification that the common stock will be delisted. At that time, the Company may appeal Nasdaq’s determination to a Hearings Panel. During this time, the Company’s securities will remain listed and trading on Nasdaq. There can be no assurance that we will be able to regain compliance with the applicable continued listing criteria within the period of time, if any, granted by the Hearings Panel. To regain compliance with the Minimum Bid Price Requirement, the bid price of the common stock must have a closing bid price of at least $1.00 per share for a minimum of 10 consecutive trading days.

The Board of Directors has determined that the Reverse Split Amendment is necessary so that a reverse split can be effectuated if required to continue the listing of our common stock on Nasdaq. The Board of Directors has determined continued listing of our common stock on Nasdaq is in the best interests of our stockholders. In addition to bringing the per share trading price and closing bid price of our common stock back above $1.00, the Reverse Stock Split if effectuated may make our common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in stocks priced below $1.00 or tend to discourage individual brokers from recommending such stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. If we were unable to maintain compliance with the Minimum Bid Price Requirement and our common stock were delisted from Nasdaq, trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the OTCQX, the OTCQB or the OTC Pink markets maintained by OTC Markets Group Inc. An investor would likely find it less convenient to sell, or to obtain accurate quotations in seeking to buy or sell, our common stock on an over-the-counter market and many investors would likely not buy or sell our common stock due to difficulty in accessing over-the-counter markets, or their own policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our common stock would be subject to SEC rules as a “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade in our common stock. In addition, if the Company’s common stock were no longer to be listed on Nasdaq, we believe the Company’s ability to effect future financings necessary to enable it to continue its clinical development would be materially and adversely impaired. For these reasons and others, delisting would adversely affect the liquidity, trading volume and price of our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

Reverse Stock Split Ratio

If approved by stockholders, this Reverse Stock Split proposal would permit but not require the Board of Directors to effect a Reverse Stock Split of our common stock at any time prior to the one-year anniversary date of the Annual Meeting by the Reverse Stock Split Ratio, with the specific ratio to be fixed within this range by the Board of Directors in its sole discretion without further stockholder approval. We believe that enabling the Board of Directors to fix the specific Reverse Stock Split Ratio within the stated range will provide us with the flexibility to implement it in a manner designed to maximize the anticipated benefits for our stockholders. In fixing the Reverse Stock Split Ratio, the Board of Directors may consider, among other things, factors such as:

-17-

The Board of Directors will have sole discretion as to any implementation of, and the exact timing and actual Reverse Stock Split Ratio of, the Reverse Stock Split within the range of Reverse Stock Split Ratios specified in this proposal at any time prior to the one-year anniversary date of the Annual Meeting . The Board of Directors may also determine that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders and decide to abandon the Reverse Stock Split at any time before, during or after the Annual Meeting and prior to its effectiveness, without further action by the stockholders.

Effectiveness of the Reverse Stock Split

If approved by our stockholders, the Reverse Stock Split would become effective upon the filing of the Reverse Split Amendment with the Secretary of State of the State of Delaware, or at the later time set forth in the Reverse Split Amendment, which will constitute the Split Effective Time. The exact timing of the Reverse Split Amendment will be determined by the Board of Directors based on its evaluation as to when such action will be the most advantageous to the Company and its stockholders. In addition, the Board of Directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to abandon the Reverse Split Amendment and the Reverse Stock Split if, at any time prior to the effectiveness of the filing of the Amendment with the Secretary of State of the State of Delaware, the Board of Directors, in its sole discretion, determines that it is no longer in our best interest and the best interests of our stockholders to proceed.

The form of the proposed Amendment to effect the Reverse Stock Split is attached as Appendix B to this Proxy Statement. Any Amendment to effect the Reverse Stock Split will include the Reverse Stock Split Ratio fixed by the Board of Directors, within the range approved by the stockholders.

Potential Market Effects of the Reverse Stock Split

The Reverse Stock Split proposal is intended primarily to increase the Company’s per share bid price and satisfy the Minimum Bid Price Requirement under Nasdaq listing rules. Reducing the number of outstanding shares of common stock should, absent other factors, increase the per share market price of the common stock, although the Company cannot provide any assurance that it will be able to meet or maintain a bid price over the Minimum Bid Price Requirement for continued listing on Nasdaq or any other exchange. The delisting of the common stock from Nasdaq may result in decreased liquidity, increased volatility in the price and trading volume of our common stock, a loss of current or future coverage by certain sell-side analysts, a diminution of institutional investor interest and/or the impairment of the Company’s ability to raise capital. Delisting could also cause a loss of confidence of the Company’s customers, collaborators, vendors, suppliers and employees, which could harm its business and future prospects.

Reducing the number of outstanding shares of common stock through a Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. The market price of our common stock will also be based on and may be adversely affected by our performance, financial results market conditions, the market’s perception of our business and other factors which are unrelated to the number of shares outstanding. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split or that the market price of the common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of common stock after a Reverse Stock Split will increase in proportion to the reduction in the number of shares of common stock outstanding before the Reverse Stock Split. In addition, the Reverse Stock Split may not result in a market price per share that will attract certain segments of the institutional investor community and the investing public that previously refrained from investing in us because of the low market price of our common stock. If the Reverse Stock Split is effected and the market price of our common stock declines,

-18-

the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. Furthermore, the liquidity of common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

In evaluating the Reverse Stock Split proposal, in addition to the considerations described above, the Board of Directors also took into account various negative factors associated with Reverse Stock Splits generally. These factors include: the negative perception of Reverse Stock Splits held by some investors, analysts and other stock market participants; the fact that the stock price of some companies that have effected Reverse Stock Splits has subsequently declined in share price and corresponding market capitalization; the adverse effect on liquidity that might be caused by a reduced number of shares outstanding; and the costs associated with implementing a Reverse Stock Split.

Potential Increased Investor Interest if the Reverse Stock Split is Implemented

On May 1, 2023, the Company’s common stock closed at $0.55 per share. An investment in the common stock at the current market price may not appeal to brokerage firms that are reluctant to recommend lower priced securities to their clients. Investors may also be dissuaded from purchasing lower priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. Also, the Board of Directors believes that most investment funds are reluctant to invest in lower priced stocks. The Board of Directors believes that the anticipated higher market price expected to result from a Reverse Stock Split will reduce, to some extent, the negative effects of the practices of brokerage houses and investors described above on the liquidity and marketability of the common stock.

There are risks associated with the Reverse Stock Split, including that the Reverse Stock Split may not result in an increase in the per share price of the common stock. The Company cannot predict whether the Reverse Stock Split will increase the market price for the common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

The market price of the common stock will also be based on the Company’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of the common stock declines, the percentage decline as an absolute number and as a percentage of the overall market capitalization of the Company may be greater than would occur in the absence of a Reverse Stock Split. Furthermore, the liquidity of the common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

Potential Effects of Proposed Reverse Split Amendment

If our stockholders approve the Reverse Stock Split and the Board of Directors effects it, the number of shares of common stock issued and outstanding will be reduced, depending upon the Reverse Stock Split Ratio determined by the Board of Directors. The Reverse Stock Split will affect all holders of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except that, as described below in “Fractional Shares,” holders of our common stock otherwise entitled to a fractional share as a result of the Reverse Stock Split because they hold a number of shares not evenly divisible by the Reverse Stock Split Ratio will, in lieu of a fractional share, receive one whole share of common stock. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The Reverse Stock Split alone would have no effect on our authorized capital stock, and the total number of authorized shares would remain the same as before the Reverse Stock Split. This would have the effect of increasing the number of

-19-

shares of our common stock available for issuance. The additional available shares would be available for issuance from time to time at the discretion of the Board of Directors when opportunities arise, without further stockholder action or the related delays and expenses, except as may be required for a particular transaction by law, the rules of any exchange on which our securities may then be listed, or other agreements or restrictions. Any issuance of additional shares of our common stock would increase the number of outstanding shares of our common stock and (unless such issuance was pro-rata among existing stockholders) the percentage ownership of existing stockholders would be diluted accordingly. In addition, any such issuance of additional shares of our common stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of our common stock. For information on the proposal to increase the number of authorized shares of our common stock, see “Proposal No. 2 – Grant Discretionary Authority to the Board of Directors to Amend our Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock from 100,000,000 Shares to 200,000,000 Shares.” The Board of Directors currently expects that if the increase in the number of authorized shares of common stock of the Company described in Proposal 2 is implemented, the amendment to our Certificate of Incorporation for the Reverse Stock Split will not be implemented.

In addition to sales of our common stock, if our stockholders approve the Reverse Stock Split and the Board of Directors effects it, the additional available shares of our common stock would also be available for conversions of convertible securities that we may issue, acquisition transactions, strategic relationships with corporate and other partners, stock splits, stock dividends and other transactions that may contribute to the growth of our business. Any decision to issue equity will depend on, among other things, our evaluation of funding needs, developments in business and technologies, current and expected future market conditions and other factors. There can be no assurance, however, even if the Reverse Stock Split is approved and implemented, that any financing transaction or other transaction would be undertaken or completed.

The Reverse Stock Split will not change the terms of our common stock. After the Reverse Stock Split, the shares of common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to common stock now authorized.

The Reverse Stock Split may result in some stockholders owning “odd-lots” of less than 100 shares of common stock. Brokerage commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of 100 shares.